5 Essentials to Becoming a Successful Investor

Control the Controllables

To support the publication and receive new articles directly to your inbox, please subscribe:

The chief task in life is simply this:

To identify and separate matters so that I can say clearly to myself which are externals not under my control, and which have to do with the choices I actually control.

Where then do I look for good and evil?

Not to uncontrollable externals, but within myself to the choices that are my own.

Epictetus

A successful investor is one who focuses on what is inside of their control, instead of concerning themselves endlessly with what is outside of their direct influence.

The media (both legacy and social) firmly direct our attention towards what is outside of our control. Keeping us hooked on a steady drip of highs and lows, short-lived dopamine hits and bouts of severe FOMO (fear of missing out).

Having our thoughts, feelings and actions dictated by others is no way to live - not just with investing, but life as a whole.

To quote White Goodman, you have to grab the bull by the horns and take control!

So, to help you grab the proverbial (or real) bull by the horns, here's a list of the 5 essentials that are directly in your control when investing:

1. Asset Allocation

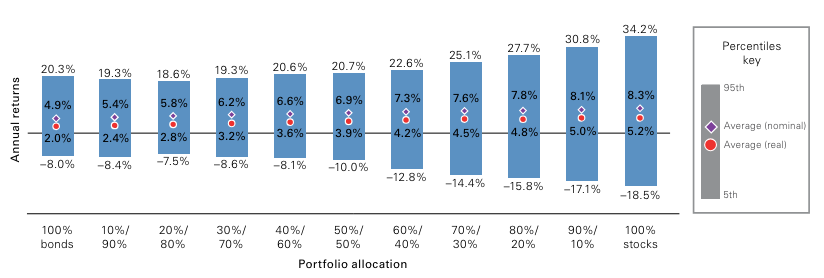

This is the biggest factor in determining your return.

Asset allocation = where you choose to invest your money.

Studies have shown that c.90% of a fund's return is down to asset allocation:

This means 90% of your investment return will be determined by what type of assets you choose to invest in.

So, if 90% of your return comes from your choice of assets, then every other choice you make about your investments only accounts for c.10% of your future return; therefore, it makes sense to pay very close attention to what you invest in.

The main assets you'll come across when investing in funds (which is generally a sensible approach) are bonds and equities. If you aren’t working with a Financial Planner, then you'll need to choose how much of your money is invested into these asset types.

What are bonds and equities?

Bonds = corporate/government debt (loaning them money for interest payments).

Equities = stocks and shares, being a part owner of the most successful companies around the world.

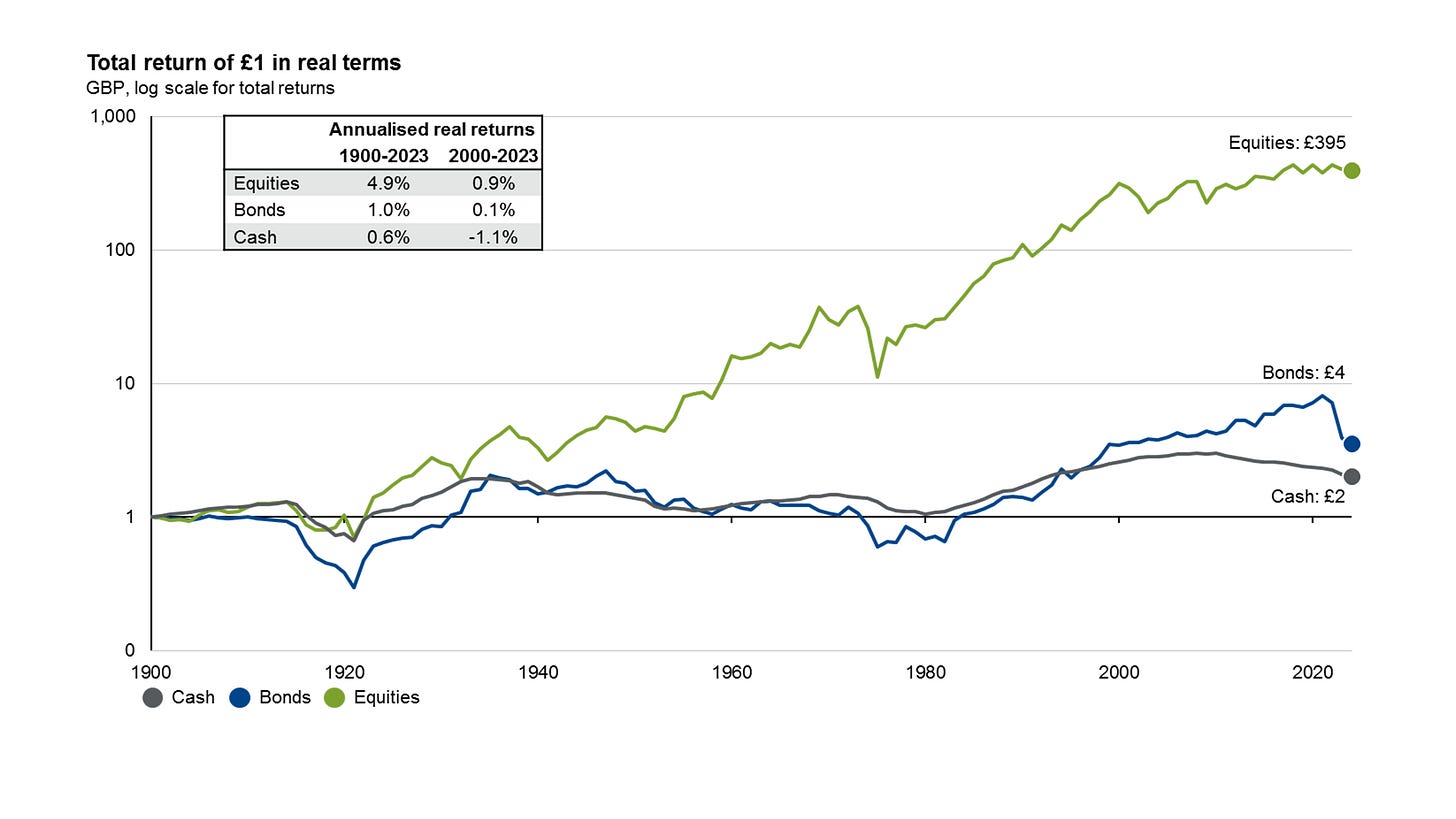

Bonds typically provide less short-term volatility (daily price movements), with a lower return over the long term.

Equities typically experience more short-term volatility, but provide the all important real returns over time:

To gain a better understanding of why real returns are the important number to focus on, check out my post: Don’t Be Careful, Be Competent.

TL/DR = real returns account for the negative impact of inflation.

Equities are the fuel for building long term wealth, whilst bonds are there to provide a (typically) smoother investment journey for those who need it:

2. Costs

Investment costs are a drag on return.

The costs you pay to invest will reduce your net real return.

The main costs to be aware of are:

Fund charges (inc. transaction costs).

Platform charges.

The more you pay, the less money you have working for you - this is negative compounding in action.

Once you’ve spent the time to sort your asset allocation (remember, this accounts for 90% of your return, so it pays to spend time on that decision), then you should look to minimise your investment fees, as they stack up over the long term.

In every single time period and data point tested, low-cost funds beat high-cost funds.

Morningstar

Utilising a nifty tool from Candid Money, let's look at the impact of investment costs on £100k over 30 years:

The above example shows the impact investment costs have on our investment returns (over £100k less over 30 years).

Please note, not all costs are created equal, as some online would have you believe!

You may’ve noticed I didn’t include adviser fees in the list of investment costs.

Financial advice is not an investment cost.

It is an ongoing, professional service, which adds, rather than detracts, value… here’s a non-exhaustive list of ways in which it does so:

Asset allocation advice (which, as we know, is a big one!).

A barrier between you and financial mistakes/scams.

Tax-efficient income/saving/retirement planning.

Support for a surviving spouse.

Accountability.

And so on…

3. Diversification

As I'm sure you know, it's about not having all your eggs in one basket.

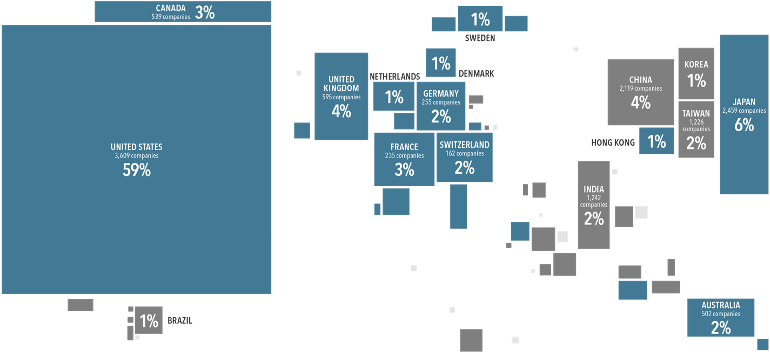

You want your money spread over lots of different companies (and/or bonds), across different regions and countries.

The reason for this is we cannot know in advance where the best returns will come from.

So, instead of trying to predict where to find the needle in the haystack, just buy the haystack.

For example, whilst the US is often the most talked about online, it isn't the best performing country every year - here are the top country returns over the last 10 yers:

As we don’t know what will happen in the future, it is best to hold a global portfolio (buying the haystack) to capture all the returns - as the cream always rises to the top.

The below shows that whilst the US makes up nearly 60% of the global market, by only investing there you are missing out on the other 40% of companies around the world providing returns:

Moral of the story, don’t pin your financial future on one country, company or crypto(!).

The name of the game is to avoid 100% capital loss and stay in invested over the long term - which you can’t do if you put all your chips on one company/crypto(!) and they go pop.

4. Automation

Building wealth involves good habits being performed consistently over time.

We, as humans, are flawed, emotionally-driven creatures – which is great for some things and terrible for others.

Unfortunately, good habits can easily be derailed by our emotional state.

When we are in the right frame of mind it is easier for us to perform positive habits; however, if we are in a bad frame of mind making good decisions becomes difficult, or seemingly unimportant.

James Clear, author of Atomic Habits, has worked out the formula for success:

The key is to put fewer steps in place between ourselves and good behaviours and more steps between ourselves and the bad ones.

With automation we can take it one step further and remove ourselves from the equation entirely! Once we have automated our savings, our wealth is free to grow to new heights which otherwise may not have been possible with our continued input/tinkering.

We are then free to go about our lives whilst good financial behaviours are happening automatically in the background – brilliant!!

Once you have a system is in place it is low maintenance and will only require the occasional review (hopefully to increase the amount you invest as you earn more).

5. Your Behaviour

As mentioned above, our habits and behaviours can have a detrimental impact on our ability to become a successful investor.

Equities don’t make people wealthy; people make themselves wealthy.

The most important variable in your equity quest is also the only variable ultimately in your control… your own behaviour!

Nick Murray

The longer you stay invested, the higher your probability of generating a positive return.

Equities may be the vehicle to long term wealth creation, but you are the driver. And a car (currently) doesn’t get very far without a driver! Which means you won’t get very far in your wealth building journey if you don’t sort out your own behaviours.

It is all about staying disciplined and ignoring the noise.

6. Summary

Asset allocation drives your return 📈

Cost dictates how much you keep 💰

Diversification prevents 100% loss ✔️

Automation stops you missing out 🤖

Your behaviour makes or breaks it 🫵

Follow the above principles and one day you should wake up to find yourself wealthy.

Please share the article with someone who’d also enjoy it, or more widely on social media, it really helps:

Subscribe to get future articles directly to your inbox!

Feel free to message me with any questions/topic ideas.

Thanks for reading,

Tom Redmayne

Cambridge-Based Financial Planner

This is not personal advice based on your circumstances.

All views are my own.