Automation is king 🤖👑

Building wealth involves good habits being performed consistently over time.

We as humans are flawed, emotionally-driven creatures - which is great for some things and terrible for others.

Unfortunately good habits can easily be derailed by our emotional state.

When we are in the right frame of mind it is easier for us to perform positive habits. However, if we are in a bad frame of mind making good decisions becomes difficult, or seemingly unimportant.

James Clear, author of Atomic Habits, has worked out the formula for success. The key is to put fewer steps in place between ourselves and good behaviours and more steps between ourselves and the bad ones.

With automation we can take it one step further and remove ourselves from the equation entirely!

Once we have automated our savings, our wealth is free to grow to heights which otherwise may not have been possible with our continued input.

We are then free to go about our lives whilst good financial behaviours are happening automatically in the background - brilliant 🙂

So, how does one set up an automatic system for accumulating wealth?

Luckily, it is a straight forward process and you may already have some of the groundwork in place.

Once the system is in place it is low maintenance and will only require the occasional review (hopefully to increase the amount you save as you earn more).

The first thing to do is to put together a budget.

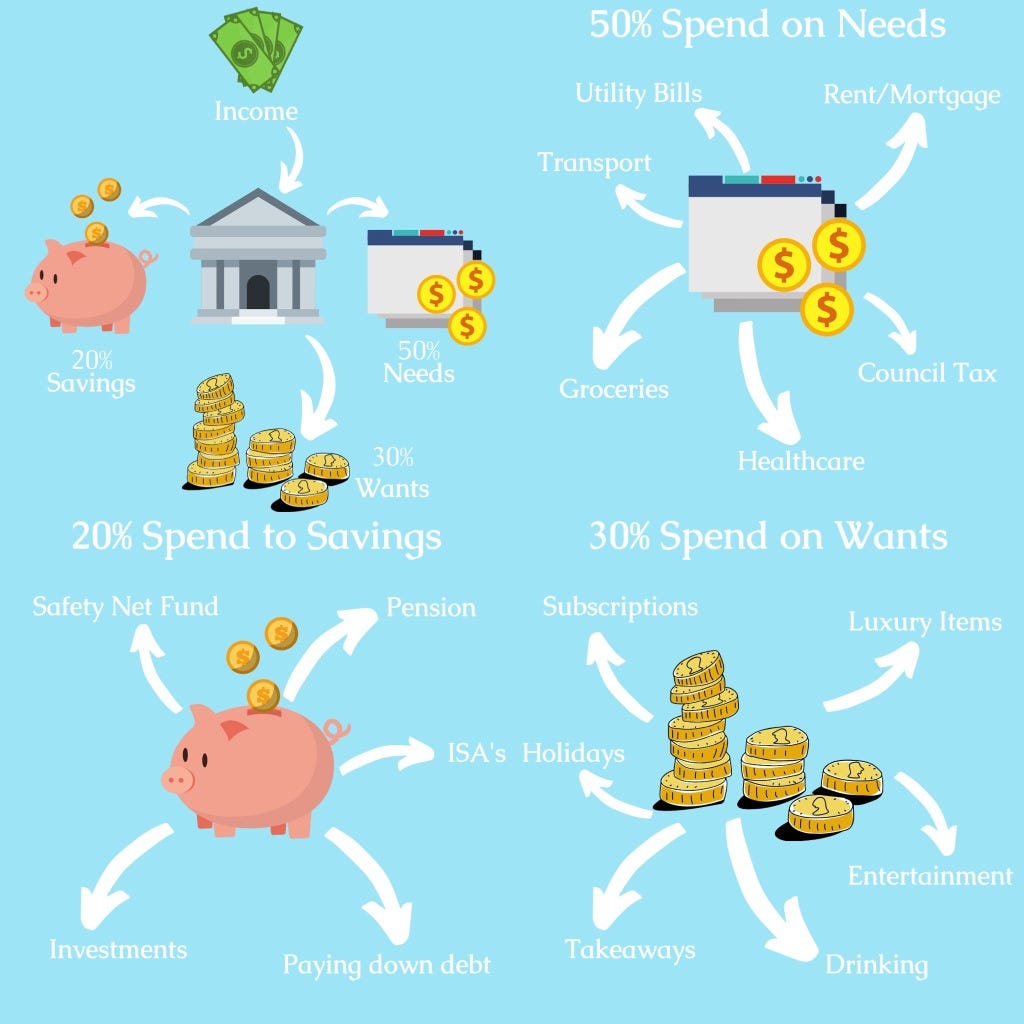

If you are adverse to budgeting, the rule of thumb to get you going is the 50/30/20 rule.

50% of your income will go on your needs, 30% on wants and 20% on savings. If you can reduce the first two and increase the savings percentage, happy days!

Once you have your budget, follow the below steps. I've used the 50/30/20 rule as the example:

Set up a new current account (this will be your 'spending account').

Create a standing order to send 30% of your income to the new account every payday.

Have the other 20% go into a savings or investment account via direct debit.

The above system will leave your current account with the 50% needed to cover all of your fixed costs for the month. You are then free to spend the 30% as you wish, safe in the knowledge that 20% has been automatically saved.

Depending upon what your current set up looks like, the above may vary.

For example, I send my fixed costs to a joint account, which covers our expenses each month. If going down that route makes sense for you, then you just need to add an extra step of moving your direct debits to the new joint account.

In the name of transparency, I must confess that I still haven't called the council to move the direct debit over to our joint account... so I move it across manually each month (I'm a flawed human, I hope you can forgive me 😄).

Consider this post a call to action.

I implore you to carve out some time one afternoon to automate your savings - it might just be the single most important thing you can do on your wealth building journey.

If, like me, you don't enjoy budgeting, it will make your life so easy and before you know it you will have saved a fair bit of wedge, with no effort at all!

If you have any suggestions on other areas that can benefit from automation I would love to hear from you. You can reach me on Twitter or at mantaroblog@gmail.com.

Thanks for reading.

Tom Redmayne

Financial Planner-in-waiting

If you enjoyed the article, you can subscribe to stay up-to-date with the blog:

[jetpack_subscription_form subscribe_placeholder="Enter your email address" show_subscribers_total="false" button_on_newline="false" submit_button_text="Sign Up" custom_font_size="16px" custom_border_radius="0" custom_border_weight="1" custom_padding="15" custom_spacing="10" submit_button_classes="" email_field_classes="" show_only_email_and_button="true"]

Check out my other posts here: