To support the publication and receive new articles directly to your inbox, please subscribe:

If you’ve already subscribed but haven’t seen the emails, please check your junk/spam!

As I was preparing for a peaceful slumber last night (by reading Antony Beevor’s brilliant book on the 1917 Russian Revolution) my mate messaged me with a ‘pretty mad’ 10% interest rate from Virgin Money for a 12 month savings account.

Immediately my alarm bells started ringing, as that rate is ‘pretty mad’ indeed.

So, I went in search of the inevitable ‘catch’.

The Product

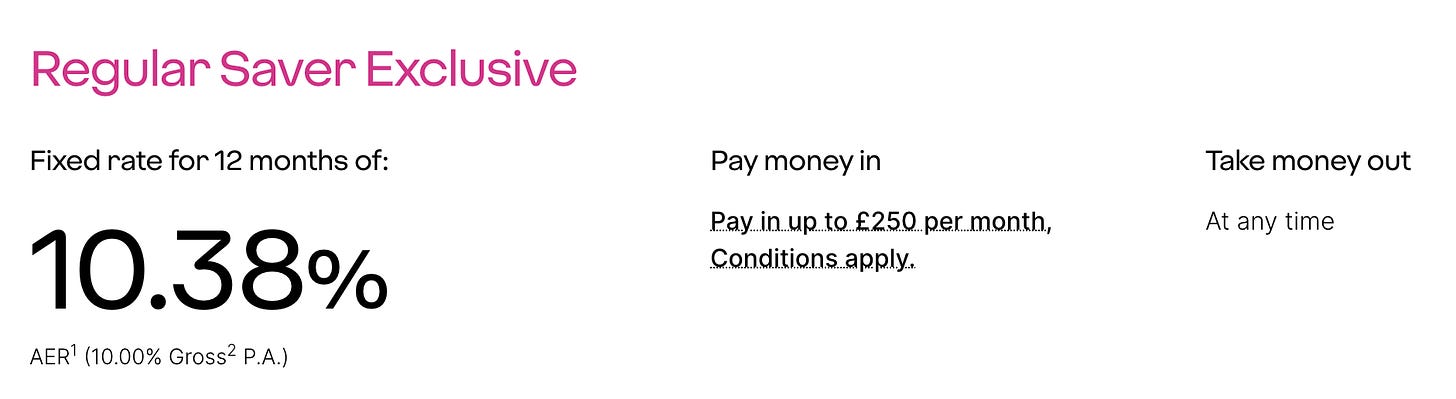

Here’s the savings account:

And sure enough, ‘conditions apply’.

Those two words are doing a lot of heavy lifting here.

So, let’s have a look under the bonnet…

The Catch

From the product FAQs:

Max deposit of £250 per month (you can deposit more, but they’ll only pay interest on the £250).

The maximum balance you can earn interest on is £3,000.

The interest is paid quarterly.

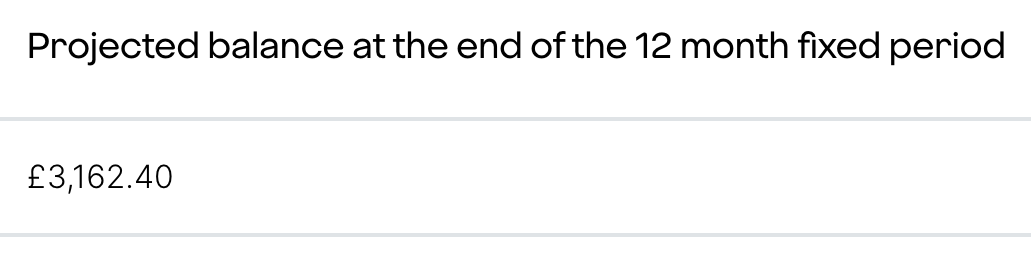

And finally, the all important piece of information - how much interest you can earn:

You deposit £3,000 (£250 x 12) and you’re projected to earn £162.40.

You don’t have to be Rainman to know that isn’t a 10% return.

In fact, it’s a return of 5.4%.

So, what’s going on?

Virgin Money are being numerically misleading ‘clever’ to get an attention grabbing headline:

The headline rate and the return generated are not always the same.

The conditions applied to this product throttle the earning potential by limiting the amount that can be deposited each month (£250) and by paying the interest quarterly (4 x 2.5%).

This example wouldn’t be out of place in an exam paper for becoming a Chartered Financial Planner (AF4 Investment Planning).

Moral of the story

When something seems too good to be true, read the ‘small print’.

In fact, before you put your money into anything, read the ‘small print’.

The importance of reading the product details was drilled into me during my time working at Hargreaves Lansdown (HL).

People would call up wanting/needing money out of their fixed term savings accounts - sometimes for a house deposit!

I had to explain, to their dismay/irritation, that they’d chosen a savings product which didn’t allow withdrawals (except on death or terminal illness).

This wasn’t only highlighted in the small print, but also in LARGE PRINT about 4 times through the application process - obviously, it was still HL’s fault and the terms should’ve been clearer…

It was frightening how many times I had this conversation and their only defence was, “I’d assumed I could just forgo the interest” 🤦♂️

Never assume.

Read the product details.

If it’s too good to be true, it probably is.

Thanks for reading,

Tom Redmayne

Chartered Financial Planner

If you enjoyed the article, please consider sharing it with someone else who’d also enjoy it or more widely on social media, it really helps:

Don’t forget to subscribe, so you can get future articles directly to your inbox!

This is not personal advice based on your circumstances.

All views are my own.