Explained: The Benefits of Inflation!

2022 has thus far been a year of bad news and previously unimaginable events!

For those folks reading this in the future, I'm sure 2022 will have been a pivotal year that everybody points to for years to come - please correct me if I'm wrong!!

You would be forgiven, if you keep up with the news, for living in constant fear.

Petrol prices are soaring, economic and political pressures are rising and the general cost of living is said to be spiking 😰

Inflation is at the centre of this fear.

What is Inflation?

It is our perpetual financial enemy.

Inflation works tirelessly to make us poorer, eroding the purchasing power of our hard earned cash by increasing prices of goods and services over time.

Inflation is forever making Freddos more expensive!

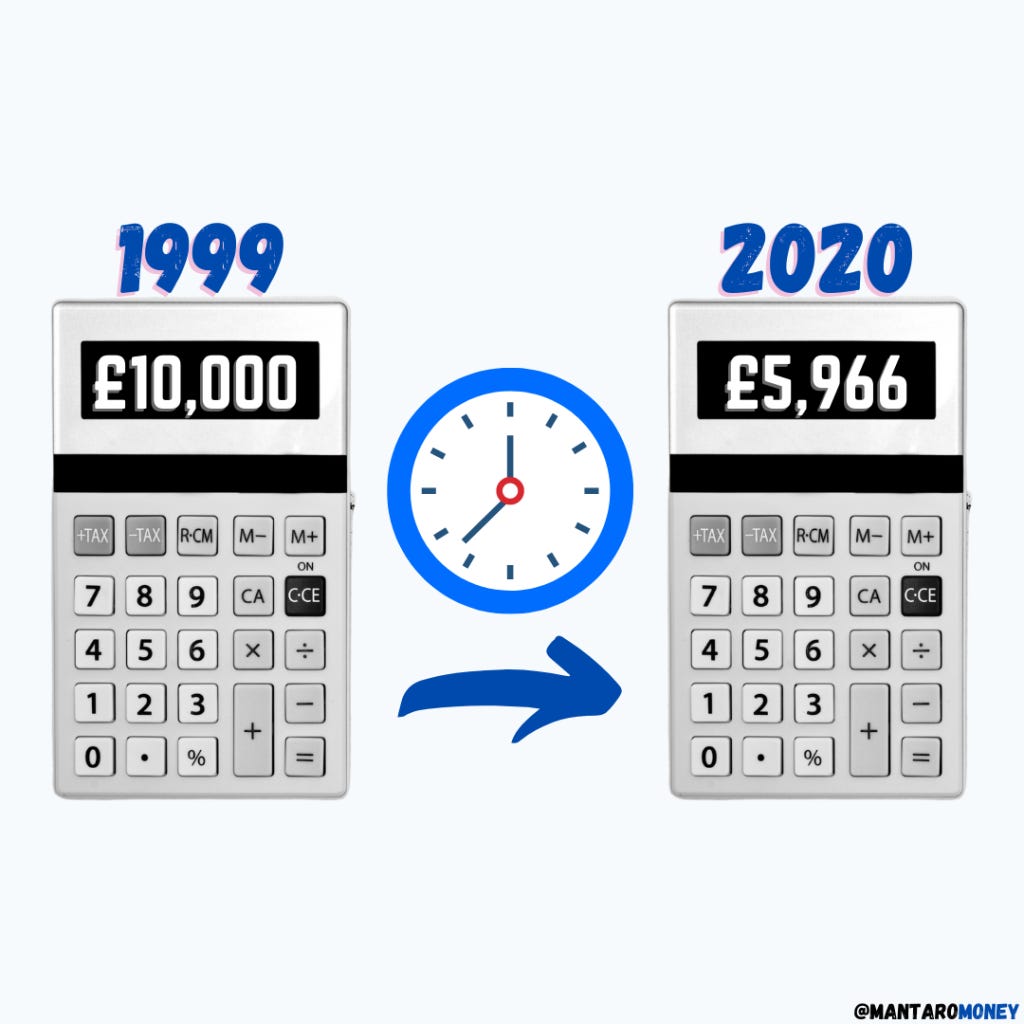

Let's look at an example.

If you put £10,000 into a bank account in 1999, 21 years later you'd only be able to buy £5,966 worth of goods 😰

Whilst the numbers in your bank account wouldn't have changed, the actual value of your money drastically decreased!

Inflation pushes up the prices of goods and services over time, meaning £100 is a lot less valuable than 50 years ago. For context, in 1972 the average UK wage was £1,872 per annum 🫢

The Flip Side

Now, whilst the above is all true, it only tells one side of the story.

News outlets only focus on what sells, negativity.

Headlines like, 'Cost of Living Crisis' or 'Millions Made Poorer' will generate far more clicks than, 'The Cost of Debt Falls' or 'Owners of Productive Assets will be OK'... I guess they could say, 'Homeowners Benefit from Others Misery!'.

So, if inflation is our enemy, how can we benefit from it?

Doesn't it only bring financial misery and destruction?! 🧐

No.

Like everything in this life, there is no Ying without Yang. No light without shade. Where there is good, there will also be bad.

For every Putin there will be a Zelensky.

As 50 Cent philosophised,

Sunny days wouldn't be special, if it wasn't for rain.

Joy wouldn't feel so good, if it wasn't for pain.

'Many Men (Wish Death)'

Deep... ✊

With all that in mind, let me explain the benefits of inflation.

To explain the benefits, we first need to look at the alternative.

What's the alternative to Inflation?

The opposite of inflation is deflation and, trust me, inflation is the lesser of two evils!

Whilst inflation increases prices over time, deflation decreases them. On the surface you might like the idea of deflation, but the truth is that deflation is the destroyer of economies!

Imagine buying a house and expecting it to go down in value, rather than up. Would you buy it?

Probably not.

As you expect the price to go down, surely you wait until it is cheaper - right? In fact, why buy anything now, when it is set to be cheaper soon?!

This is what happens on a vast scale in an economy experiencing deflation.

Nobody buys anything, so things get cheaper, so nobody buys anything, so things get cheaper.

It is an economic death spiral ☠️

The Benefit of Inflation on Debt

Inflation. Debt. Both are typically 'nasty' words when thrown about.

Whilst individually they can lead to financial ruin, they do make for rather good bedfellows.

Inflation erodes our purchasing power, which means £100 today is worth more than £100 tomorrow or next year. Not good.

However, it is good when you owe money.

If you lend me £1,000 today and we agree that I'll pay you back £100 a year for ten years, then I am quids in!

Whilst the headline amount of £100 remains unchanged, each year £100 becomes less valuable.

I benefit from buying stuff worth £1,000 now and then pay less and less back for it each year.

This is why lenders typically charge interest!

However, even with interest being charged, if inflation is higher than the interest being paid, then you are still winning.

People on fixed rate mortgages can benefit from this. For example, you lock in a mortgage rate for 5 years at 2%, inflation then spikes to 6%. Ideal 🙌

Inflation erodes the value of money, so the money you are paying back on your mortgage becomes less and less valuable.

The Benefit of Inflation on Assets

If inflation makes things more expensive, then it stands that those who own those things will see their value increase.

So, those who own assets providing goods and services are in a strong position.

Here's why:

Business increases prices of it's goods/services

Revenue and/or profit of the business goes up

Business becomes more valuable as a result 🤌

Due to this, productive assets (businesses and property) typically outpace inflation.

Therefore, inflation punishes consumers and rewards owners... which are you?

Check out my blog post Owner > Consumer for more details on why you need to own productive assets 🤝

Conclusion

Inflation is both our enemy and potential ally.

To reap the benefits of inflation you need to:

Own productive assets

Utilise debt strategically (e.g. 0% finance)

Using debt can be risky, so be sure to use it carefully!

Thanks for reading,

Tom Redmayne, DipPFS 👋

Lover of Productive Assets & Friend to Inflation

Did you find that useful?