To support the publication and receive new articles directly to your inbox, please subscribe:

Follow The Data

Science is the practice of observing something, recording those observations, then using the data collected to make informed decisions; it is an ever-evolving field of study. The never-ending pursuit for improved understanding.

Without data, you are just another person with an opinion.

W.E. Demming

As time passes, many theories or ‘facts’ that were once revered are disproven and consigned to history.

As a species, it is vital that we never stop probing, testing and questioning the status quo.

If something is disproven, then it is only sensible to follow the data and move on.

Fluidity is essential.

Unfortunately, we (humans) rather like things to stay the same. We enjoy the comfort of consistency. The safety of the status quo. The reassurance of remaining in place.

The Curious Case of Bloodletting

Bloodletting, the process of draining a patient's blood to heal them, was an activity that persisted for over 2,000 years.

Physicians from antiquity through to the 20th century were draining the blood from their patients for an array of ailments.

During the Middle Ages it was standard practice and the first course of action for many doctors of the time.

For some reason, no one was paying attention to the patients becoming weaker and often dying from losing too much blood.

Case in point, George Washington likely died from over-zealous bloodletting.

He woke up one morning with a sore throat and phlegmy chest, so his physician drained c.40% of his blood from him!

Surprisingly enough, after losing that much blood, it didn’t take long for him to die.

Whilst bloodletting had declined in popularity by the 18th century, the practice persisted into the 20th century - with some prominent figures continuing to advocate for the treatment.

Even after it was found to be an ineffective, and often dangerous treatment, the practice took over 100 years to dwindle from daily existence.

We, as humans, are stubborn creatures of comfort.

Mix these natural tendencies in a pot with the need to earn money, and you can quickly see why disproven practices persist.

As the ol’ sayin’ goes, “it is difficult to get someone to understand something, when their income depends upon them not understanding it”.

And it isn’t just the need to earn that allows such things to persist. An important factor is when the belief is intrinsically entwined with someone’s identity.

If you have made your name as a bloodletting doctor, then your self-worth will be tied to that practice, and you will likely be blind to any of the data suggesting it’s ineffectiveness.

Modern Day Bloodletting

Traditional active investment management (high charges and guesswork) is the modern equivalent of bloodletting.

'Financial bloodletting'.

The patient (client) is treated with 'financial bloodletting' (high charge, active fund) as a remedy for their ailment (their cash not outpacing inflation), before being partially drained by the physician (fund manager).

There are millions of retail investors who are unwittingly being overcharged for underperformance.

They are yet to discover that they have signed up for prolonged 'financial bloodletting'.

All the while the fund manager becomes wealthier from the practice, regardless of performance. They've mastered the art of draining their patients to the verge of death, without killing them off.

Just as the parasite doesn’t want to kill their host, the traditional active manager wants to keep their prey alive, whilst extracting the highest viable amount of capital.

There is a wealth of investment data out there, which is being continually dissected and analysed, that shows the probability of success from this style of active fund management…

Dear patient, I’m afraid the chances of success are slim.

An active manager has little hope of sustained outperformance in the long term.

The probabilities are not in their favour. Without a functioning crystal ball it’s near impossible to consistently outperform the global stock market.

Whilst the practice of 'financial bloodletting' might not kill you, it could leave you without sufficient income in retirement.

Do not allow yourself to be bled dry.

The Data

Don’t just take my word for it, here's some of the data:

Orange = bad for active fund managers.

Lots of orange = very bad for active fund managers!

As you can see, over 90% of the funds analysed underperformed over a 20 year period.

Here’s some US-specific, showing the rates of underperformances are high even over shorter timeframes:

(There are links to the data at the end of the article).

The Financial Conduct Authority (FCA), the industry’s regulator, conducted a study in 2017 which concluded that where consistent performance exists within active management, it is only for consistent underperformance:

There is little evidence of persistence in outperformance in the academic literature… the majority of funds with historical outperformance do not continue to outperform the relevant market index or peer group for more than a few years.

By contrast, where performance persistence has been identified in the literature, it is poor performance persistence.

It appears traditional active managers are only consistent at one thing, persistent poor performance.

In a 2014 paper, Blake, Caulfield & Ioannidis delivered a scathing verdict on active managers:

The vast majority of fund managers in our dataset were not simply unlucky, they were genuinely unskilled.

However, a small group of “star” fund managers are genuinely skilled… but they extract the whole of this superior performance for themselves via their fees, leaving nothing for investors.

Whilst some fund managers may be genuinely talented, their performance mainly benefits them and it is unlikely they will perform well over a long time period.

By selecting an active fund you are choosing a team of individuals to predict the future and buy the right stocks ahead of time - which, unsurprisingly, is quite a challenge without a functioning crystal ball.

Asset management is one of the most profitable industries in the UK and it thrives on chronic underperformance.

Bloodletting is good business…

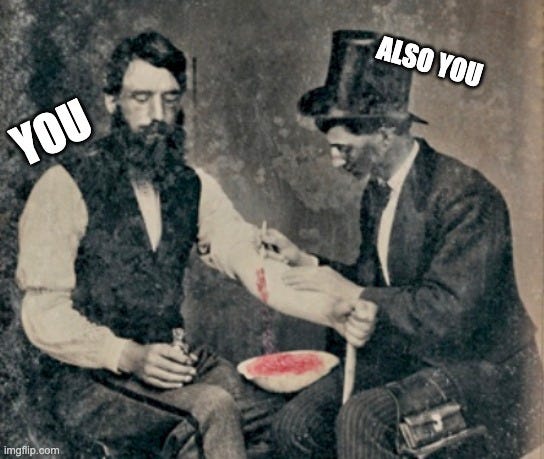

Self-Inflicted 'Financial Bloodletting'

Now that I've sufficiently bashed up active managers (with their own performance data), it is important to note that you are also able to perform 'financial bloodletting' on yourself - here's a few ways that spring to mind:

Choosing funds and platforms with high charges.

Trading too often.

Spending too much.

Not saving enough.

Being under-diversified.

The majority of crypto purchases.

Please do not be the mastermind of your own financial downfall!

Further Resources

Thanks for reading,

Tom Redmayne

Cambridge-Based Financial Planner

The value of investments can go down in value as well as up, so you could get back less than you invest. It is therefore important that you understand the risks and commitments.

This is not personal advice based on your circumstances.

All views are my own.