The Death of Alpha

One of the most profitable industries in the UK thrives on chronic under-performance.

In this post I dive headfirst into the ongoing war within the investment industry, Alpha vs Beta. Active vs Passive. Complexity vs Simplicity. Good vs Evil...

Before we get stuck in, here's a quick overview of the key terms:

Alpha and Beta are two key measurements used within the investment industry.

Alpha measures the return of an investment against a particular benchmark or market index. An Alpha of 5 would mean the investment has outperformed it's benchmark by 5%. Inversely, an Alpha of -5 would mean it has under-performed by -5%. When you invest in an active fund you are typically paying the fund manager to find Alpha.

Beta measures the volatility of an investment in relation to the market. The Beta of the market is shown as 1. If your investment has a Beta of 1.5, then your investment is 50% more volatile than the market. If the Beta was 0.5, then its 50% less volatile. When you invest in a passive fund you are typically paying to achieve Beta (less charges).

If that made no sense to you then hopefully this simplified example will:

If you are not familiar with funds (active or passive) you can find out more in my quick guide, what is a fund?.

If you are happy with the above, then let’s jump in.

The investment industry is set up around the promise of delivering Alpha to retail investors. For the last 70 years or so, achieving Alpha has been the promise from the institutions and the expectation from investors. You more regularly hear it referred to as 'beating the market'.

The titans of industry employ lots of clever people in an attempt to generate excess returns for their investors, allowing them to charge a premium for their service.

You may be asking yourself, what's the problem with that?

Well, the issue is that no one can consistently beat the market. It is becoming increasingly difficult for Alpha to be found and there is a wealth of evidence to back this up (Rock Wealth have a great knowledge bank linking to studies).

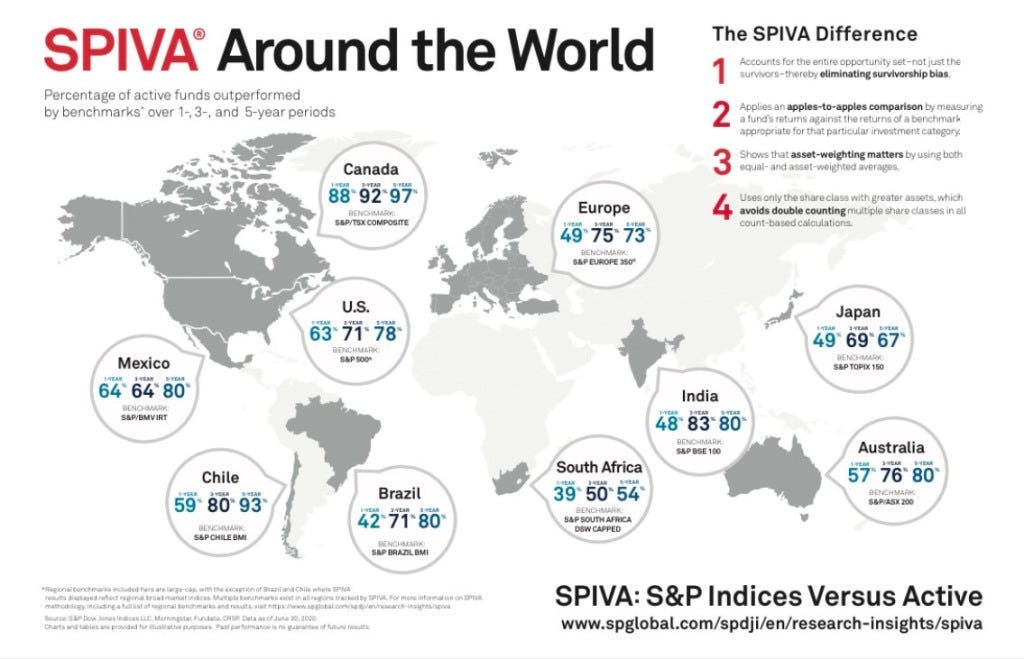

The below info-graphic from SPIVA highlights how many active funds under-perform over a one, three and five year period:

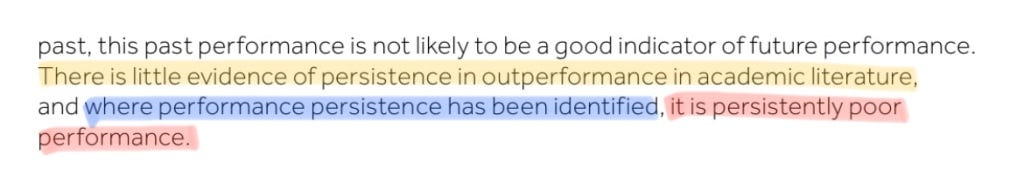

The Financial Conduct Authority (FCA), who is the industry’s regulator, conducted a study in 2017 which found that where consistent performance exists within active management, it is only for consistent under-performance:

To address the issue of delivering Alpha we need to head back in time.

In the good ol' days, there was no internet. Information did not spread around the globe at the speed of light. It was a time where information was scarce and the scarcity of information gave the investment houses their competitive advantage.

Seeking out advantageous investments through scarce information used to be the industry's bread and butter. The industry was set up on beating the market, as it used to be a more feasible proposition.

Fast forward to the modern day and everyone has up to date information at their finger tips. There is a parity of information in the marketplace. Technology has removed the industry's competitive advantage.

Due to the speed of technological innovation the investment industry is now a legacy operation.

It is yet to catch up with the speed of change in the new world. People are still being charged a premium for a pre-internet era service in the age of the internet.

A lot of investors in active funds are being overcharged for under-performance.

I call this the 'Alpha Tax'.

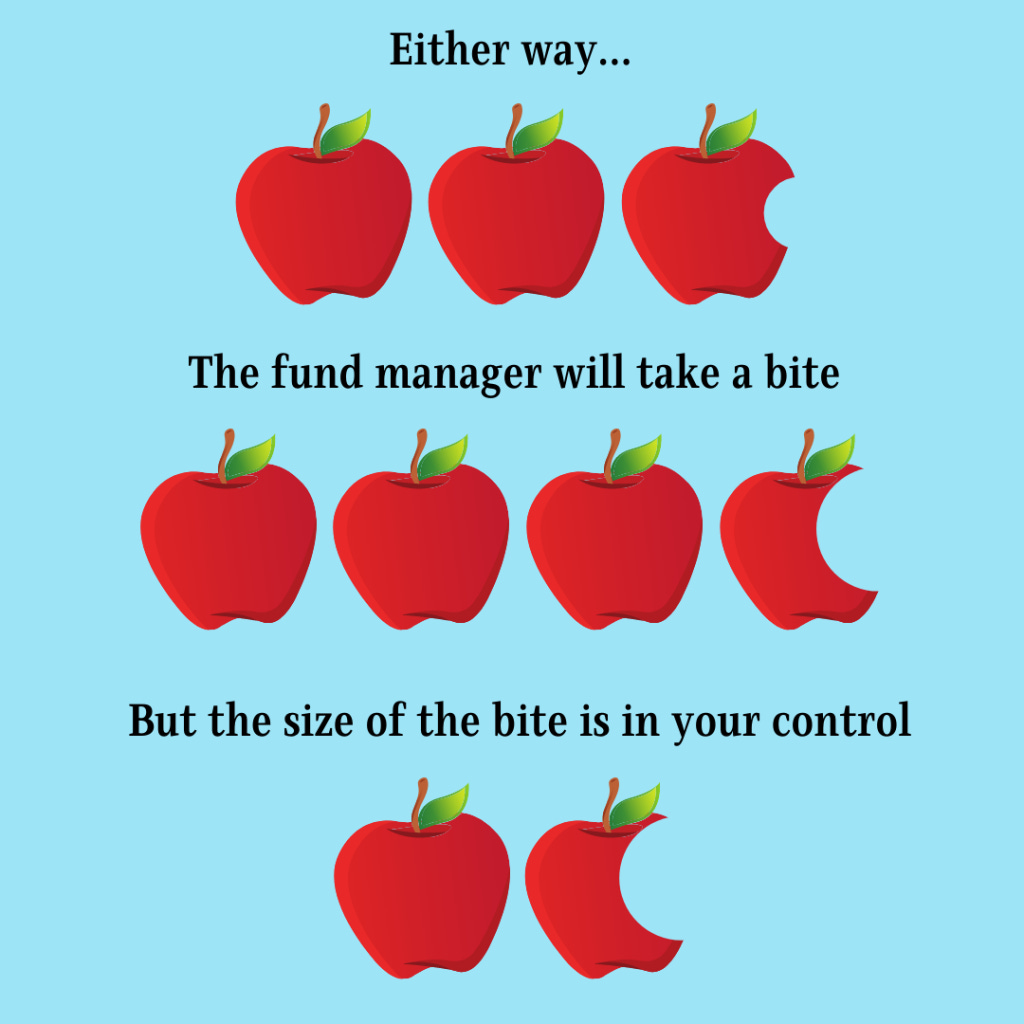

Now, it is worth highlighting that you will typically not achieve Beta with passive funds, due to the ongoing management fee (which is typically a lot lower than an active fund):

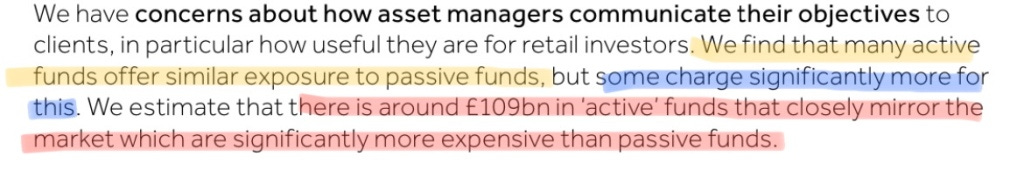

Even more worryingly, lots of active managers now just 'hug the index'.

What does ‘hugging the index’ mean? They are running a passive fund but charging active fund management fees.

They are effectively selling an expensive tracker fund that promises the world but doesn't deliver.

The FCA highlighted this in the same 2017 study where they estimated about £109bn of investors’ money was tied up in such funds:

Whilst a lot of investors are unwittingly holding these hidden trackers, even more are exposed to the main risk of active management, human judgement and skill.

In a 2014 paper called "New Evidence on Mutual Fund Performance: A Comparison of Alternative Bootstrap Methods", Blake, Caulfield & Ioannidis deliver a scathing verdict based on their research:

Whilst some fund managers may be genuinely talented, their performance mainly benefits them and it is unlikely they will perform well over a long time period.

By selecting an active fund you are choosing a team of individuals to predict the future and buy the right stocks ahead of time - which is unsurprisingly quite a challenge without a crystal ball.

The investment industry consistently overcharges for under-performance, and as there is a lack of competition they are not having to lower their prices.

The interests of the retail investors are second to that of the industry and their shareholders.

The average investment firm makes 36% profit a year (2017 figure) – making the fund industry one of the most profitable in the UK.

Let that sink in...

One of the most profitable industries in the UK thrives on chronic under-performance.

So, what does the future hold for those seeking Alpha?

Whilst I do not have a crystal ball, judging by the current trend money will continue to flood out of active funds and into lower cost passive alternatives:

According to Morningstar, between January - November 2020 European passive funds received an additional $111 billion in new money.

The future does look bleak for active management companies. My personal view is they will either need to adapt or die.

I believe active funds will become the niche, not the norm.

Whilst I have spent this article bashing up the active management industry, I do in fact hold one active fund.

Active funds do perform well in some sectors, typically where information is scarce - such as smaller companies, illustrated by the below graph:

However, as the graph shows there is no guarantee that they will outperform. Smaller companies inherently pose higher risks, especially when you are paying a set of individuals to pick a portfolio for you.

I personally have a 'thematic' active fund, which is where I feel active managers can offer value. A thematic fund is one that concentrates on a particular niche or theme.

I hold a 'global energy transition' fund, which invests throughout the supply chain of renewable energy (excluding nuclear).

I am happy to pay a higher charge for this fund, as I am interested in the sector and believe an active manager has an opportunity to outperform due to the scarcity of information.

Even if the fund does not outperform, I want to expose my capital to this sector as I believe it to be important for all our futures.

Therefore, I have invested in the fund for more than performance reasons, it aligns with my values and by allocating some of my capital to it I feel I am helping out.

I do believe active investing can still have a place in a portfolio. I do not believe it to be necessary, but if you enjoy it then why not.

I believe a thematic approach to active investing can add value. Utilising active funds to target a particular niche or sector allows you to expose some of your capital to your particular areas of interest.

If you find an active fund within a niche of interest and are aware of the additional risks, then you should feel free to crack on.

To clarify, the majority of my portfolio is within globally diversified passive funds, I only have a small allocation within an active fund.

To conclude:

The active management industry overcharges for under-performance

Alpha is hard to find and seemingly impossible to find consistently

Active funds are suffering large outflows and may become the niche, not the norm

Whilst active funds can still be used by investors, they should beware of the Alpha Tax

Thanks for reading.

Tom Redmayne

Financial Planner-in-waiting