The most important finance book I've read.

I cannot stress enough the importance of the message delivered in Paul Armson's book, 'Enough? How much do you need for the rest of your life?'.

It may change your life!

I highly recommend reading the book, it is a short read that really packs a punch.

The below is my summary which highlights the two key points:

Life is not a rehearsal, we only get one go at it. So do not spend it on things that don't fulfil you.

Everybody has a 'bucket', this bucket is filled with your liquid assets and has to last your lifetime.

Enjoy :)

To reiterate, life is not a rehearsal, I am afraid none of us are getting out of here alive.

As such, money should be viewed as a tool to live your best life.

You cannot take it with you and it will be of no use when you arrive at the pearly gates.

Once you have come to terms with this fact, material wealth and status will slip to the wayside.

With that out of the way, lets move onto Paul's bucket analogy - a concept I wish they taught at school!

Everybody has a bucket.

In this bucket are all your 'liquid assets', that is any money you have easy access to.

Such as, the cash in your current account, savings account, premium bonds, ISA's and any investments you hold outside of a pension that can be easily liquidated (sold).

These liquid assets fund your lifestyle. Having a grasp of YOUR bucket is essential.

Outside of your bucket sits all your illiquid investments, these are assets that you do not have immediate or easy access to.

Such as, your house (if you own one), any other properties, your pension pot(s) and any businesses you may own.

These assets do not fund your current lifestyle, however they will hopefully grow over time and one day end up in your bucket to fund your future lifestyle in retirement.

When it comes to the buckets, there are only three types of people.

One of the main problems people have is not knowing which person they are. That means that the three types of people are all prone to anxiety and stress around their money.

Understanding your bucket can help take away those negative feelings.

Don't worry if you are in the 'not enough' camp, now you know and can take positive steps to become 'just right' :)

If you are in the 'too much' camp, you have a good problem on your hands - figuring out how to spend that excess money in a meaningful way!

If you are still young and only beginning to fill up your bucket, then the below can provide clarity and will help you meaningfully plan your future.

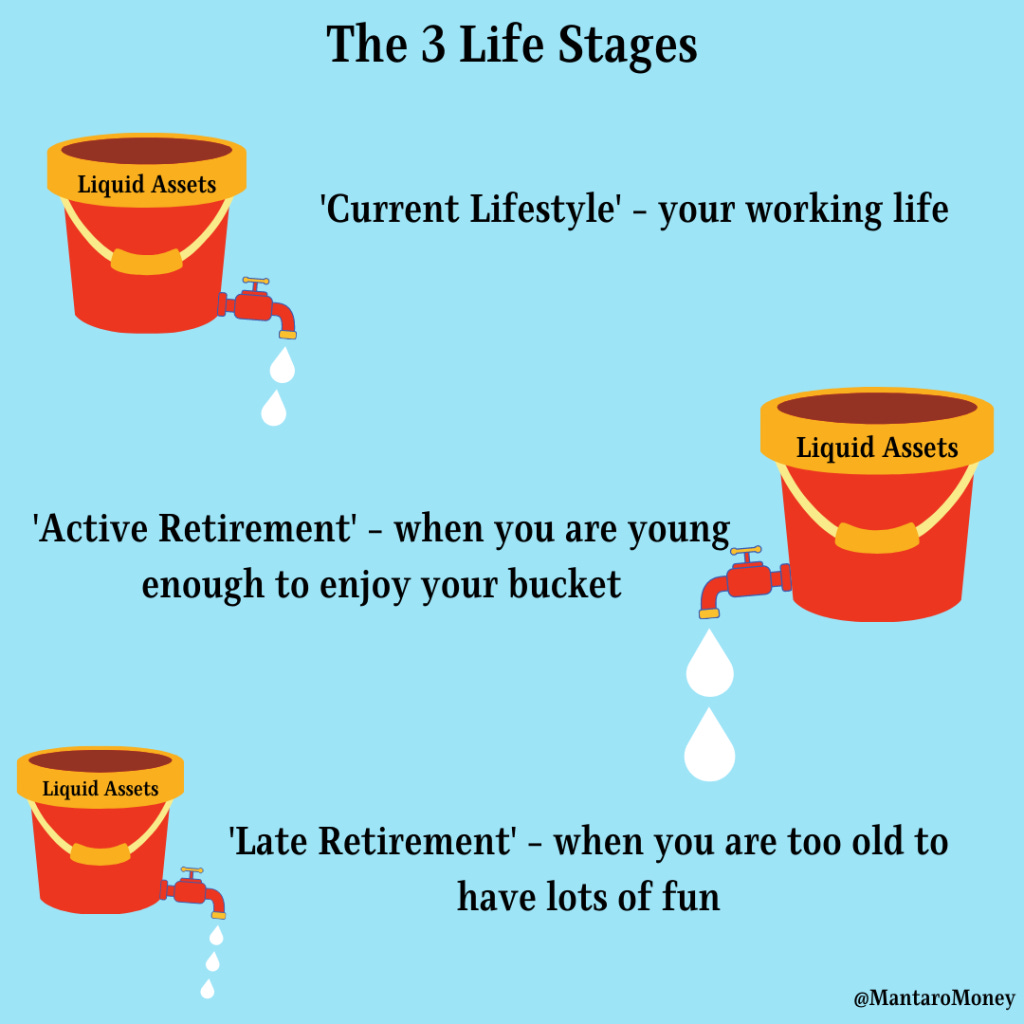

As well as the three types of people, there are three key life stages we go through.

The 'current lifestyle' is right now, unless you are already retired (if so, feel free to skip ahead).

In this stage you will be busy filling up your bucket and hopefully building up some illiquid assets too.

Whilst filling up your bucket you still have to live, so there is a tap on the bucket to pay for your lifestyle.

The trick is to balance the inflows and outflows so that your bucket gets fuller over time, whilst still enjoying yourself.

Life is not a rehearsal, so do not make unnecessary sacrifices and ensure you still have some fun.

Tomorrow is not guaranteed.

'Active retirement' is when you have filled up your bucket with enough assets to last you the rest of your life, so you can stop working and start spending.

During this time you may start accessing some of your illiquid assets to top up your bucket (e.g. drawing from your pension, selling your business or downsizing).

Ideally you are still young and healthy enough during this stage to have fun, so it should be the time that you spend the most money.

Go on adventures, give to charity, drive down Route 66, sail the seven seas - whatever tickles your pickle!

Life is not a rehearsal, if you've made it this far then make sure you enjoy it.

'Late retirement' is the final stretch, when you're too old to have as much fun. You will probably be tired from your 'active retirement' and will just want to chill out.

Research has shown that whatever your level of affluence your household spending will diminish as you make your way into 'late retirement'.

Ensure you have enjoyed the first two life stages to the max, as you'll be needing fond memories to look back on in.

And then, I'm afraid, it's all over.

Your remaining assets become 'your estate', which will be distributed according to your will (make sure you have one!).

If you do not have a plan in place prior to your demise, you may find a good chunk of your estate will end up in the chancellor's pocket - which is not ideal!

So, work out what a good life means to you and use your money to live that life. If you want to help others, do so when you are alive, so you can enjoy the benefits.

The book goes into more detail on this and working with a financial planner may also be beneficial.

Being the wealthiest person in the graveyard is not a badge of honour, it shows that you did not live your life to its full potential.

Remember:

Life is not a rehearsal, so grab the bull by the horns and leave here with a smile on your face.

Everyone has a bucket, think of this concept when you are planning your life and your money.

Read the book, you won't regret it.

I'll leave you with the same quote Paul ends the book on, from Hunter S Thompson.

Thanks for reading.

Tom Redmayne

Financial Planner-in-waiting