The UK’s ‘Not So Mini-Budget’: What it Means for You

What's Happened?

Liz Truss (our new PM) and Kwasi Kwarteng (our new chancellor) dropped an economic and political bomb on Friday (23/09/22). The aftershock of which could be felt for years to come.

The bomb, which they are calling a ‘mini-budget’, is our first real introduction to ‘Trussonomics’.

In summary, the plan is to borrow more and tax less.

What the government has done is akin to someone increasing their living expenses (more borrowing), whilst simultaneously slashing their income (reducing tax)… not great maths.

They are gambling that UK economic growth will outpace the cost of borrowing.

The ‘not so mini-budget’ includes the biggest tax cuts in 50 years, whilst also increasing borrowing by £100’s of billions!!

This year alone government borrowing is set to reach £190bn…

A key question is, who’s going to pay for all this borrowing? They haven’t, as yet, provided an answer to this question.

So far, the markets have reacted badly. The pound (GBP) has plummeted to historic lows against the dollar (USD), which has a variety of consequences for our economy and the UK public.

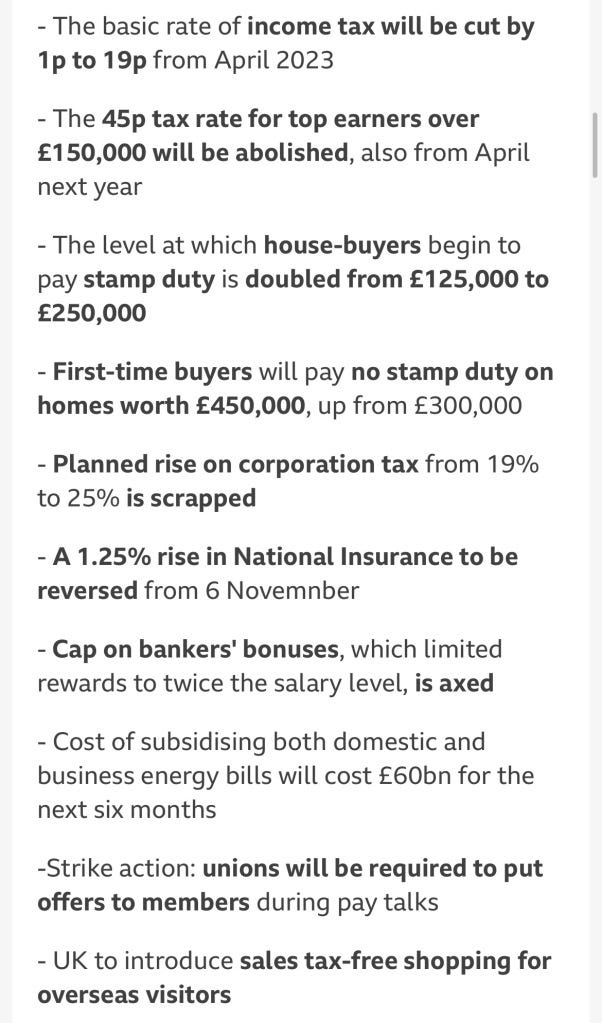

Here’s a full summary of the announcements:

Liz vs Bank of England (BoE)

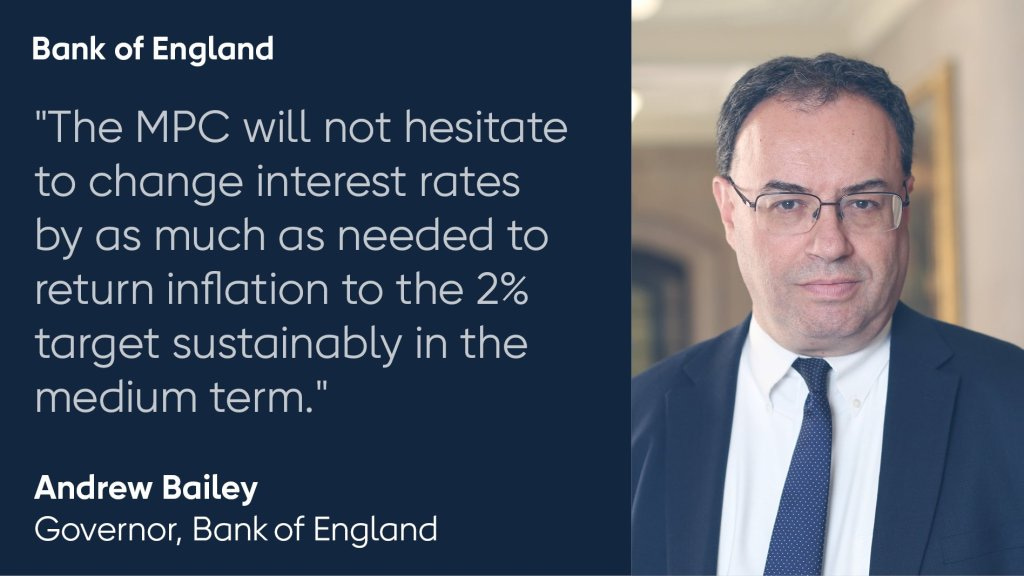

One notable aspect of the ‘not so mini-budget’ is that it goes against the BoE’s current strategy. The BoE has been trying to get inflation under control by increasing interest rates to slow growth.

Higher interest rates = higher borrowing costs.

Higher borrowing costs = higher mortgage costs.

Higher mortgage costs = higher rental costs.

The list goes on...

Liz and her merry band of scoundrels are doing the exact opposite. They are trying to stimulate growth in a high inflation environment, which could lead to even higher inflation and/or a strong reaction from the BoE (increasing interest rates again).

In simple terms, the BoE are making borrowing more expensive to stop people spending; whilst the government is cutting taxes to help people spend.

The more people spend, the more inflation increases. The higher inflation goes, the higher interest rates become.

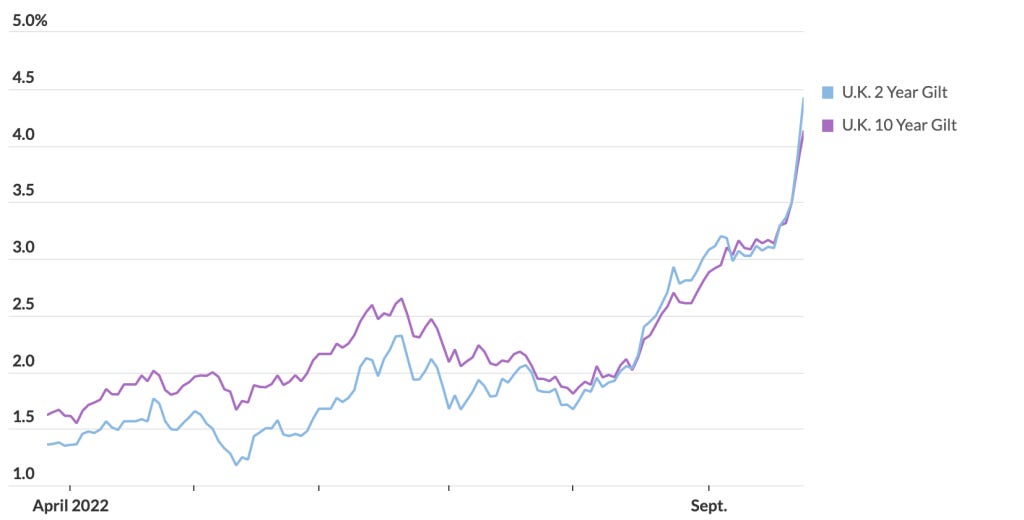

High inflation and expected higher interest rates have crashed UK GILT prices, which increases the yield (the % the government has to pay for debt). So, the ‘not so mini-budget’ is effectively shooting itself in the foot:

The plan is to borrow more, and they’ve just made borrowing more expensive… not great maths.

Anyone else feeling Ready for Rishi?!

A Weak Pound(ing)

GBP falling to historic lows against USD has some potential pros and a lot of potential cons.

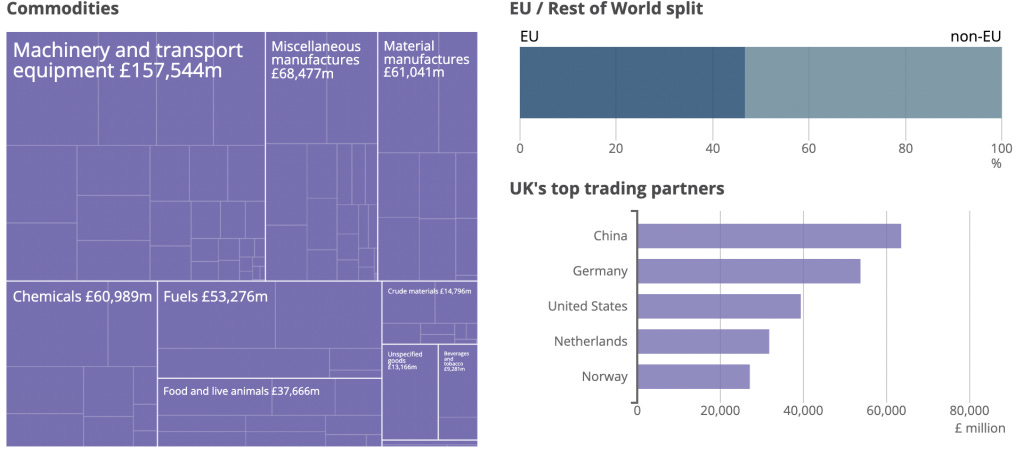

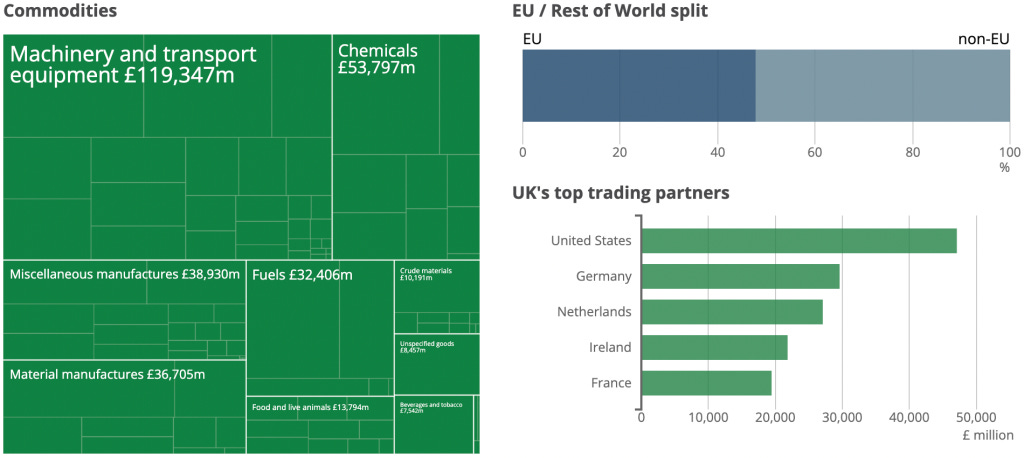

The UK buys in more goods from abroad (imports) than it sells abroad (exports) – this is called a ‘trade deficit’ - details below:

2021 Imports: £477,858 million

2021 Exports: £321,792 million

A weaker GBP makes it more expensive to buy goods from other countries and it makes it more attractive for other countries to buy from us (as they can get more for their money).

So, there is potential for an increase in our exports, which can be good for the economy; however, we are heavily reliant on imports, which is likely to make a lot of the things we buy cost more.

A key issue is the ongoing energy crisis.

Oil and gas are priced in USD, so it has just become more expensive for us to buy in oil and gas and the government will now need to borrow more to cover their subsidies to help support us through the energy crisis.

What Does this Mean for You?

Let’s start with the good news, you’ll pay less tax on your income and potentially no/less stamp duty when buying a home – all good stuff!

We paid c.£3k in stamp duty on our first home in June, under the new rules we wouldn’t have paid anything.

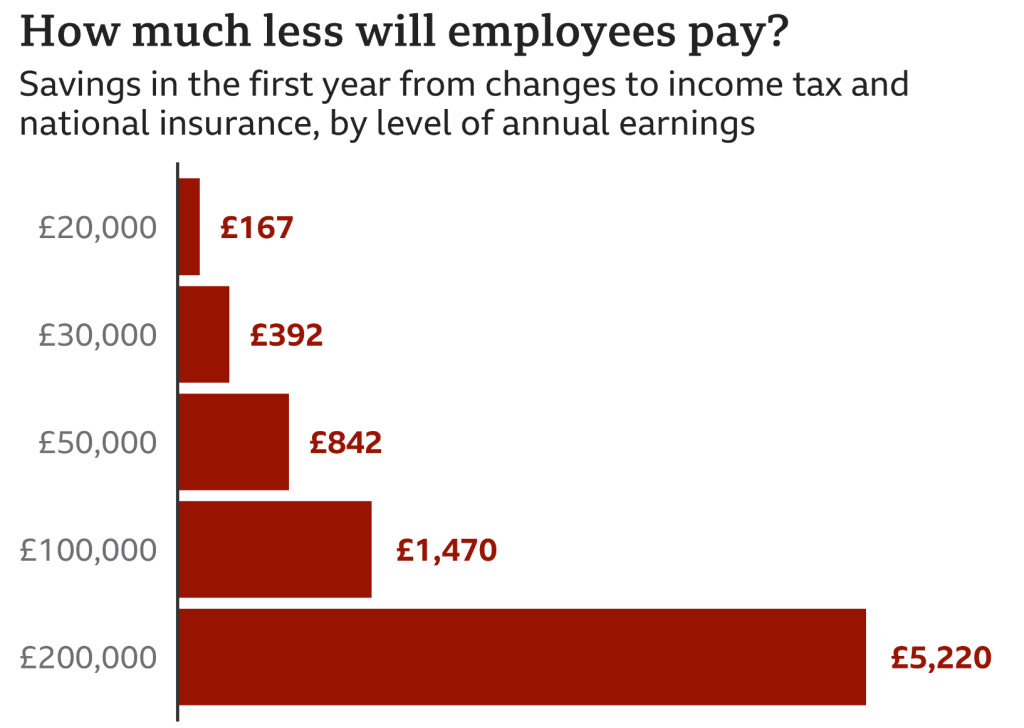

Here is a snapshot of potential tax savings:

(If you aren't sure how UK income tax works, check out my explainer post here.)

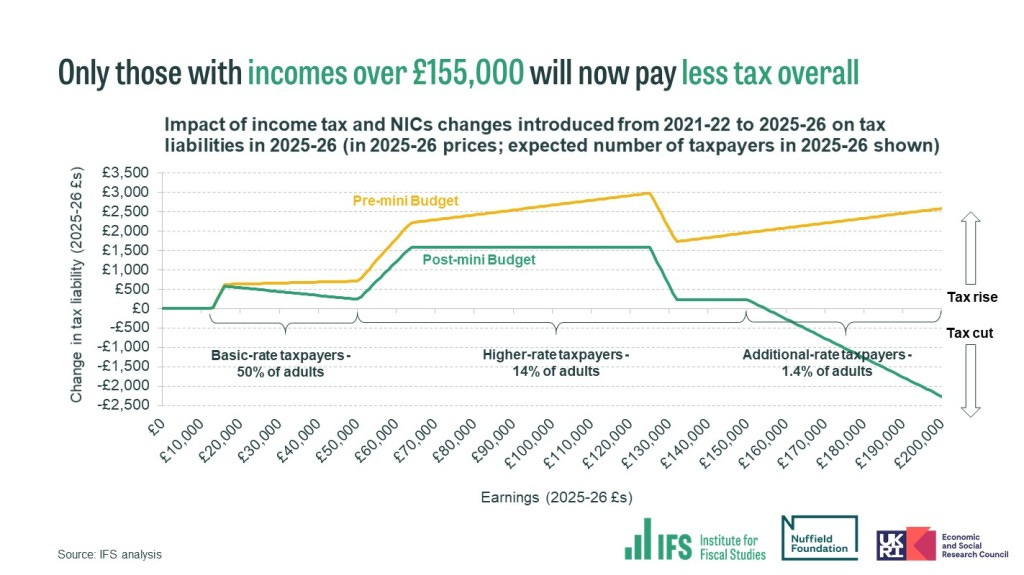

Whilst everyone benefits to a degree, high earners are the real winners from the ‘not so mini-budget’:

How are earners under £155,000 still paying more tax overall? The Personal Allowance is frozen until 2026.

Now, the bad news…

Mortgages and imported goods will likely cost more

Inflation will continue to erode the purchasing power of our money

Going abroad will be more expensive

The reduction in stamp duty could price out more first-time buyers (see the previous stamp duty holiday for reference)

Suddenly, it is easy to see how the tax savings can easily be eaten up by increased costs.

Liz has just thrown fuel on the cost-of-living crisis fire.

I’d like to have some more positive spin for you on this, but it escapes me!

Maybe the government’s gamble will pay off and the UK economy will soar, and we’ll become an economic titan once again…. I’m not a gambling man, but I don’t think the odds are in our favour with this one.

What Can You Do About It?

The cure is simple to say, but hard to implement:

Spend less, earn more.

To be honest, that is the cure for most financial woes in life.

I appreciate spending less is especially hard with costs going up, some of us may have some fat that can be trimmed from our budgets.

The trick, if possible, is to reduce your spending without negatively impacting your quality of life.

Unfortunately, it costs money to live, so there is only so far you can get with slashing your budget!

On the other hand, earning more has no such limit. There are no quick fixes with this, but it can be done.

Typically, the easiest way to earn more is to change jobs.

Some people are very good at this and successfully job hop for a pay rise every 12-24 months.

I’m afraid that loyalty often doesn’t pay!

Personally, I’ve been focusing on ‘up-skilling’, by getting qualifications that open doors to opportunities which would otherwise be closed. It has taken 3 years thus far, but my earning potential is steadily on the rise.

Conclusion

Liz and Kwasi have bet the house with this move.

There is a fine line between bravery and stupidity, and we won’t know which side they’re on until we have the benefit of hindsight.

I’m all for economic growth and prosperity, so I don’t disagree with their objective, but their tactics do seem silly to me.

Whilst I agree with Winston Churchill that you cannot tax your way to prosperity, you also cannot borrow your way out of every problem!

Time will tell, but the initial reaction has not been good.

(It is worth noting that I do not have any political affiliation and I’m also not an economics expert. Also, this is a fast-moving situation, so please do not take what I say here as gospel, because it may soon be outdated. I’ll endeavour to update this if I notice any big changes!)

Stay tuned & thanks for reading,

Tom Redmayne

Financial Planner/Trussonomics Skeptic

If you enjoyed the article, please subscribe: