To support the publication and receive new articles directly to your inbox, please subscribe:

Property.

The holy grail.

An aspiration for many.

It’s safe to say, we’re property mad in the UK.

When I speak to folk about investing, invariably they mention a desire to buy an investment property.

A sensible goal… or is it?

Disclaimer

In this article, I’m going to bash property.

This isn’t to say you shouldn’t invest in property, it may well be a sensible thing for you to do.

However, buying a property is a complex, costly and risky business, so it’s best to go into such an endeavour with a firm understanding of the potential downsides.

If, after reading this article, you still wish to continue, then I’ll be happy in the knowledge that you know what you’re getting yourself into.

Buckle up.

Background

I was born and raised in Cambridge during The Golden Era for property and my father spent 40 years in that world.

I have friends, family and clients who own investment properties.

Unsurprisingly, based on this early exposure, the first business book I ever read was about building a Buy-to-Let (BTL) empire. I had visions of amassing a property portfolio that would, as the book suggested, generate a passive income.

Today, that idea couldn’t be less appealing.

The Golden Era of property is over.

Today, it’s only the shadow of this era luring people towards investing in property.

A lot has changed.

Unfortunately, it’s no longer 2004.

The Golden Era: 1990s - 2010s

The good ol’ days!

Back when you could get a pint of lager and a 10-pack of Mayfair for under a tenner.

“Pint of Fosters and a packet of pork scratchings please”

-16 year old me playing it cool in 2007

Back when mortgages were given out as freely as custodial sentences for Facebook posts today.

BTL investors thrived during this time:

They could secure mortgages with less scrutiny (easy access to borrowed money).

Interest rates were, at times, low (esp. post 2010).

House prices were more affordable:

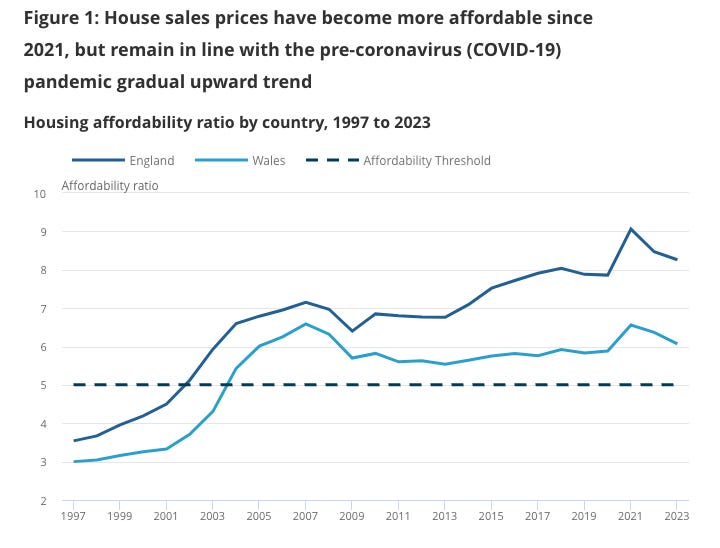

Source: ONS They had generous tax relief on their mortgage interest (they could deduct the full amount of mortgage interest from their rental income when calculating their taxable profit - thereby reducing their tax liability).

And property values soared in relation to wages (this chart is particularly depressing if you’re young, sorry):

Property was seen as a no-brainer.

You could buy it with (sometimes) cheap, borrowed money, get a decent rental yield, benefit from generous tax relief and to top it all off, you’d likely secure some great capital appreciation over time too.

Times were good and business was boomin’.

But alas, no more.

Unfortunately, it’s 2024.

The Current Era

I won’t dwell on the current era for too long - as we all live here already!

Here’s a summary:

Rising interest rates have increased mortgage costs, making it more expensive (and, as a result, less profitable)…. remember BTL and company mortgages are typically more costly than residential ones.

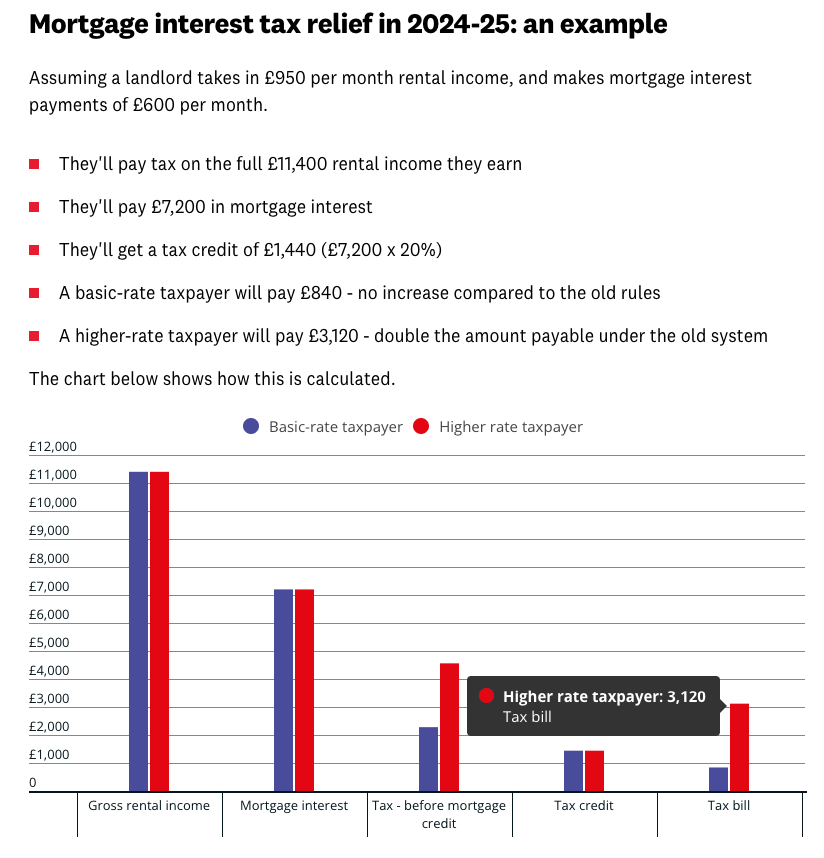

More punitive taxes have been introduced: you can now only claim 20% tax relief on mortgage interest payments for BTL properties, there's an additional 5% stamp duty when buying second properties and income tax thresholds have been frozen for some time, pushing more rental income into the higher tax bands:

It’s harder to secure a mortgage due to stricter rules and stagnant incomes.

Rental yields are down.

Right, feeling good?

Now we’ve established it’s no longer 2004, lets cover off some of the other factors to consider when buying a property before ending with the alternative:

Not-so-passive income.

The hassle factor (this is a big one for me!).

Taxes.

Illiquidity.

Void periods.

Concentration.

Negative equity.

Added complexity.

Investment returns.

Passive Income

There is nothing passive about property income.

Property is not a passive investment, it is a business. And, like any business, it comes with risks and hassle (in the hope of turning a worthwhile profit).

Time, ongoing maintenance, bad tenants, void periods, costs, changes to laws, regulations and tax etc.

Even if you use a management company, it will never be truly passive.

If you invest in property be prepared to spend your time and money on it. You should see it as starting, and running, a business - not as a passive income stream.

The Hassle Factor

Property is a ball ache. There’s no avoiding it.

Be ready for cladding scandals, nuisance tenants, burst water pipes, broken washing machines, unhappy neighbours, unavoidable bills, illiquidity, void periods, ad-hoc gardening and DIY, changing regulations, increasing costs, tax returns, accountancy costs… the list goes on.

Personally, I’m busy enough working, spending time with my family, attempting to play golf and generally enjoying life.

The thought of the hassle factor alone is enough to put me off.

Ball. Ache.

Taxes

You’re taxed when you buy it (at the standard stamp duty rate plus another 5%… on a £350,000 property that’s an extra £17,500 on top of the standard £7,500 [if purchased next tax year]… giving you a total of £25,000 SDLT to pay upon purchase).

You’re taxed on the income (with 20% tax relief available on your mortgage interest payments).

If you’re buying an investment property, I’ll assume you have a good income - which means most of your rental income will likely be pushed into the 40-45% tax bands whilst you’re working.

And you’re taxed on the gain if you sell (18-24% capital gains).

Death and taxes, ey.

Liquidity

Or lack of….

Property is illiquid, which means you cannot easily get your money out.

If you’ve ever bought or sold a property then you know it is not a quick process, with 4-6 months being the average (according to a quick Google).

Think hard before locking up your capital - the opportunity cost might be high.

Void periods

This is when your tenant leaves and isn’t immediately replaced by a new one (we can also include a tenant not paying rent in this).

Just because you have no rent coming in doesn’t mean your expenses stop.

You still have to pay the mortgage and the other bills - which are no longer covered by the rent and/or the tenant paying directly (think energy bills).

Void periods can get painful real quick.

Need access to some capital to help cover the bills? Unfortunately, it’s locked up in the house…

Concentration risk

You’re buying a single, tangible asset (which you may see as a positive).

By doing so you are concentrating wealth into a single, illiquid asset. You’re putting your eggs in one basket - a basket that you cannot readily access.

You are - quite literally - putting your money on the property performing better than all other alternatives.

Investing in a property is the opposite of diversification.

Negative Equity

Hopefully, this won’t happen to you - it’s unlikely, but not impossible.

This is when the house price falls to a lower value than the outstanding mortgage - which means you are servicing a debt which exceeds the value of the asset.

The real problem arises here if you needed to sell and the proceeds of the sale aren’t enough to pay off the mortgage (bad place to be).

Complexity

Being a BTL landlord, or other type of property investor, adds complexity to your circumstances.

I see it first hand with clients. The ones with properties have to deal with more complexity.

Typically, they enjoy the whole process and working with property, so it’s not a big issue for them; however, as they get older, it can become more of an issue.

There’s often chat to buy via an LTD or to put the property in trust… sure, you can do that, it may be even be sensible to do so - just be aware of the additional cost and complexity that comes with those options.

Some people enjoy this added complexity.

Not me. I’m in favour of elegant simplicity.

Complexity is the thief of joy and a breeding ground for errors, whilst also adding additional costs.

Investment returns

I’ve intentionally left this one until the end, as it’s important to understand what’s involved first.

So, with all that said, what returns can you expect?

Personally, they’d need to be mind-blowing to deal with the hassle we’ve just gone through!

Unfortunately, they’re not.

I went deep into the ONS data (2005 - 2023), so you don’t have to!

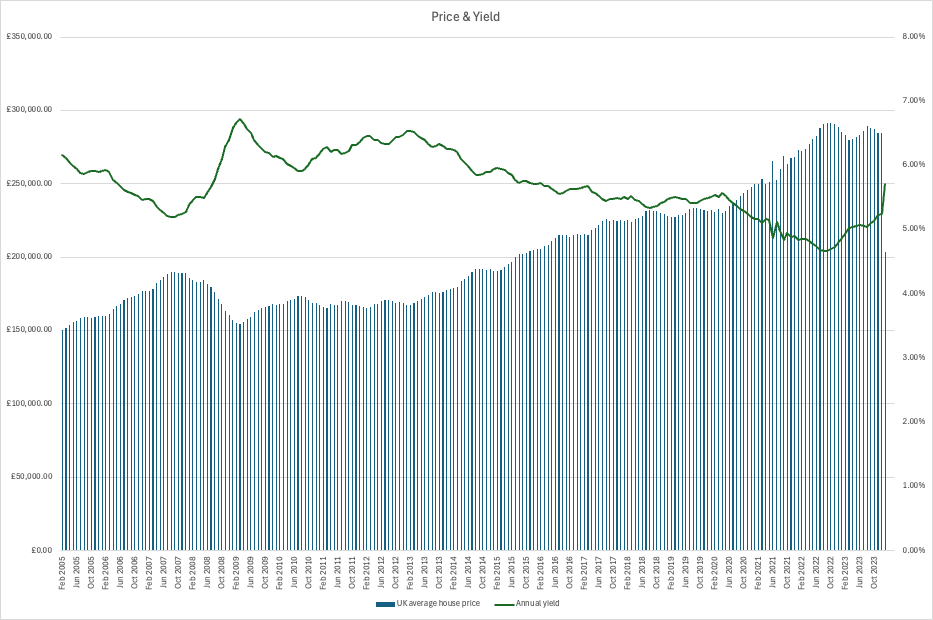

Here are average UK house prices, overlaid with the average annual rental yield:

No leverage

Lets start by keeping it simple and ignore leveraging via a mortgage and say you bought a house outright in 2005 for £150,488.

From February 2005 to December 2023, the house increased by £134,203 (89%).

Based on the average yield over time, you’d have received £216,769 in gross income (not accounting for costs or taxes).

Therefore, your total (gross) return (which includes your original capital), if you sold in December 2023, would’ve been £501,456 (233.22%).

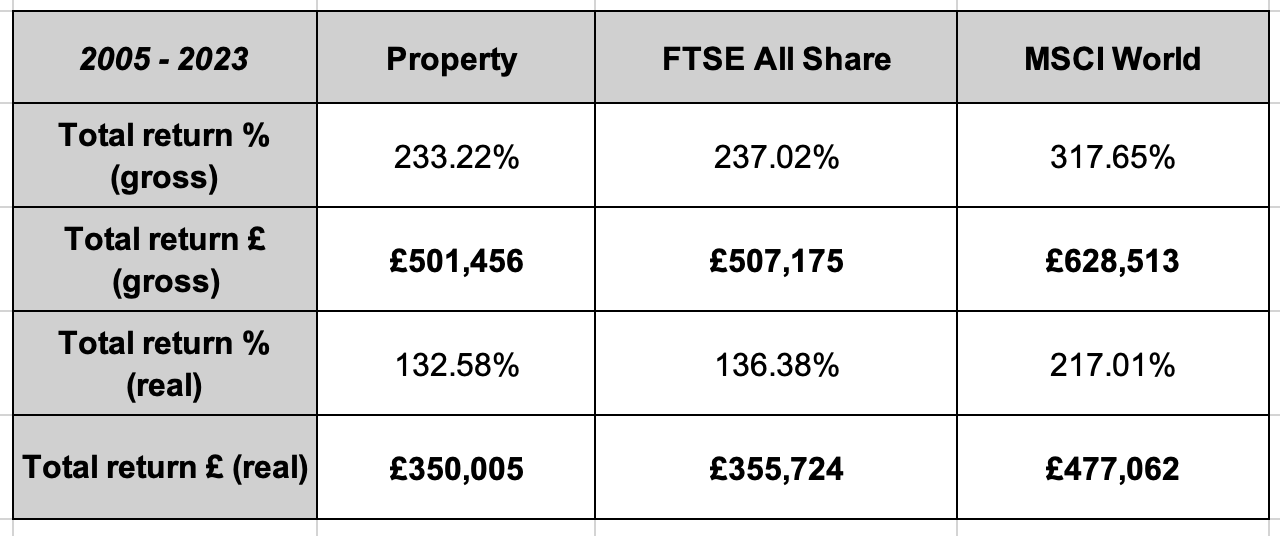

Now lets look at the actual returns achieved if you had instead invested the money in equities (UK only or globally):

(The red line is inflation, which is important to factor in).

OK, lets stack up the different returns, with and without inflation:

As we know, to be a competent investor, we need to be outpacing inflation - which all of them do (the real return); however, none of the above figures include ongoing costs or taxes.

Based on this article, we know there are a lot of costs and taxes for property.

Therefore, the 132.58% real return for this property will be a decent chunk less after properly accounting for costs and taxes1.

In fairness to this property example, none of the above takes into account the ability to utilise leverage to purchase a more expensive asset that you otherwise wouldn’t have access to.

So, will you be able to leverage enough additional capital to offset this difference in performance?

Leverage

Whilst the above example sets the scene, it doesn’t tell the whole story, as a key benefit of property investing is leverage (using borrowed money - a mortgage - to make money).

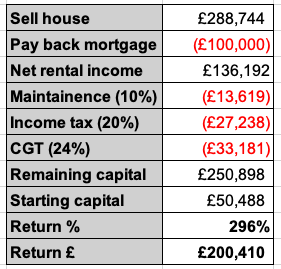

So, how does it look if you instead took out a £100,000 mortgage to buy the property in 2005?

Much better:

The above is a more realistic example of someone investing in property during The Golden Era2 and may’ve led to a better result than investing in the FTSE All Share.

The return with leverage is much better because they had access to cheap money (via low interest rates), generous tax relief and lower house prices which appreciated.

Today, houses cost a lot more. Interest rates are higher, taxes are higher and the tax relief has been squeezed.

Yes, the returns were good, but are they worth the extra hassle and what’s the likelihood of getting a similar return over the next 18 years?

There are no crystal balls, so you’ll have to be the judge.

The alternative

I’m sure you can guess what my preferred alternative is.

Yes, investing in low-cost funds with exposure to global equities via tax-efficient wrappers (+ some bond exposure, if needed).

This article is getting long, so lets quick fire this section:

Global equities includes property exposure via property investment companies - so you aren’t missing out on ‘property gains’.

The historical returns are better (no guarantee of future returns, obviously).

You can invest in them via tax-efficient wrappers, such as ISAs and pensions.

You can do so in a low-cost manner.

You can benefit from the wonders of compound interest.

They are truly passive, you can set and forget (this is a sensible strategy).

There are no void periods. The great companies of the world never cease to operate.

Your portfolio will not call you at 3am with a burst pipe.

You have more flexibility with withdrawal strategies.

The capital is liquid (unless in a pension then you’ll need to be 55+ to access it).

And, best of all, it’s less complex.

(PS, not advice).

Conclusion

Clearly, property isn’t for me.

But it might still be right for you - it depends.

People have done well from, and enjoyed, property investment.

However, many of them began during The Golden Era - so don’t let the siren song of a time gone by lull you into a false sense of security.

The rules have changed. The game has changed. The environment has changed.

Be safe out there!

Want to secure your financial future?

Clicking the button will generate a contact form.

We'll then have an initial conversation to better understand your needs/wants/aspirations and to see whether my services would be a good fit.

Thanks for reading,

Tom Redmayne

Chartered Financial Planner

Supporting my work

If you enjoy my content, here’re some simple ways to lend support:

Giving the article a like (if you liked it) - this helps the Substack algorithm find me and recommend me to new readers.

Subscribing (if you haven’t already).

Sharing also really helps my work find a wider audience:

Thank you!

This is not personal advice based on your circumstances.

All views are my own.

The property figures are based on long-term average data, whilst the FTSE and MSCI data is actual - you may’ve done much better, or worse, with property over this period.

The example may be overly generous, as I’ve kept all income taxed at the basic rate for simplicity - it’s likely it would’ve probably had some higher rate exposure. Costs would’ve likely been higher and it doesn’t factor in the risk of any void periods. It also assumes the rent was routinely increased. It does not factor in the ability to deduct SDLT and certain other expenses from the gain. On the other hand, depending where you invested in the country and over what time period, you could’ve done better - averages, ey.

Great piece. This should be circulated in every golf club and yoga class across the country.

Perfectly put Tom. Couldn’t agree more. Interestingly as we ‘speak’ I’m travelling in Southeast Asia where the myth of property riches is just taking hold…maybe it’s hose riches will be here for a while, maybe not…