Explained: UK Income Tax & National Insurance

Featuring austere gingerbread men and Yemeni goats...

By 2027–28 the number of people paying income tax at 40% or above will reach 7.8 million - that’s one in five taxpayers and one in seven of the adult population – a near-quadrupling of the share of adults paying higher rates since the early 1990s.

-IFS (The Institute for Fiscal Studies)

Introduction

With the UK population experiencing the (almost) highest tax burden since the ‘good ol’ days’ (post WWII), it’s important to understand how your hard earned cash is/isn’t taxed.

The UK tax system is archaic; filled with nuances, hidden ‘marginal rate’ traps and seemingly nonsensical rules.

For example, what do well-accessorised gingerbread men and Yemeni goats have in common?

They are both victims of VAT discrimination.

Gingerbread Men

An austere gingerbread man, solely adorned with chocolate eyes for decoration, is not subject to VAT; whilst their more flamboyant gingerbread neighbour, who dares to also be adorned with chocolate buttons and/or a belt(!), is subject to VAT (increasing the price by 20%… a high price to pay for accessorising a biscuit!).

Yemeni Goats

If you buy clothing made with either goat skin or fur, the garment will only be subject to VAT if the goat that kindly donated the raw materials originated from Mongolia, Yemen or Tibet.1

Any sufficiently detailed VAT rule is indistinguishable from satire.

-Dan Neidle (Tax Policy Associates)

Frankly, the UK tax system can be a bloody nightmare to navigate.

Whilst the media and our political parties bang on about an array of taxes - such inheritance tax and capital gains tax - nearly two thirds of UK tax revenue comes from just three taxes; income tax, national insurance (NI) and VAT (the first two are taxes on income and the latter is a tax on spending):

You may think that income tax is a simple topic, with just three income tax bands to worry about (20% / 40% / 45%); unfortunately, you’d be wrong.

Depending on the type of income received you may be taxed nothing at all, only 8.75%, or - if you fall into a tax trap - 60%+.

So, the aim of this post, dear reader, is to give you a better understanding of how two of the three main taxes (income tax and NI) impact you.

Due to the depths of this topic, this is a longer article than usual from me, so here’s a contents table for ease:

Contents:

Definitions

Myth Busting

Types of Income

Personal Allowance

Taxed by Stealth

Income Tax

Dividend Tax

Marginal Rate Tax Traps (a must read for those earning £100,000+)

ISAs & Pensions

It Depends…

Enjoy!

Definitions

Income tax: a tax on some types of income (detailed below).

NI*: another tax on income which is used as a qualification for certain state benefits; most notably, the state pension.

In 2024, you need 35 qualifying years of NI contributions to qualify for a full state pension (yes, the state pension is a benefit; in fact, it’s the single largest expense of our welfare state - taking up c.42% of the total spend2).

NI is a widely misunderstood and slightly confusing tax. The easiest way to think of it is as a second income tax.

*There is also employer’s NI, which is paid by businesses for the pleasure of providing employment; however, we won’t cover that part of the tax in this article - we’ll keep it focussed on personal taxation.

Myth Busting

Income tax and NI are both subject to myth and misconception.

Income tax:

In 2021, I ran a poll on my (now dormant) Instagram page where 30% of the respondents believed a higher rate taxpayer pays 40% tax on all their income - which is incorrect.

(July 2024 update: a new poll found 49% of people get this wrong).

Income Tax in the UK is tiered.

Being a higher rate taxpayer does not mean all of your income is subject to 40% tax.

A higher rate tax payer’s income is spread across three different tax bands (detailed below).

NI:

It is a widely held misconception that NI contributions operate like some sort of savings account, where your contributions are ring-fenced to then pay you your state pension in the future - which is, again, incorrect.

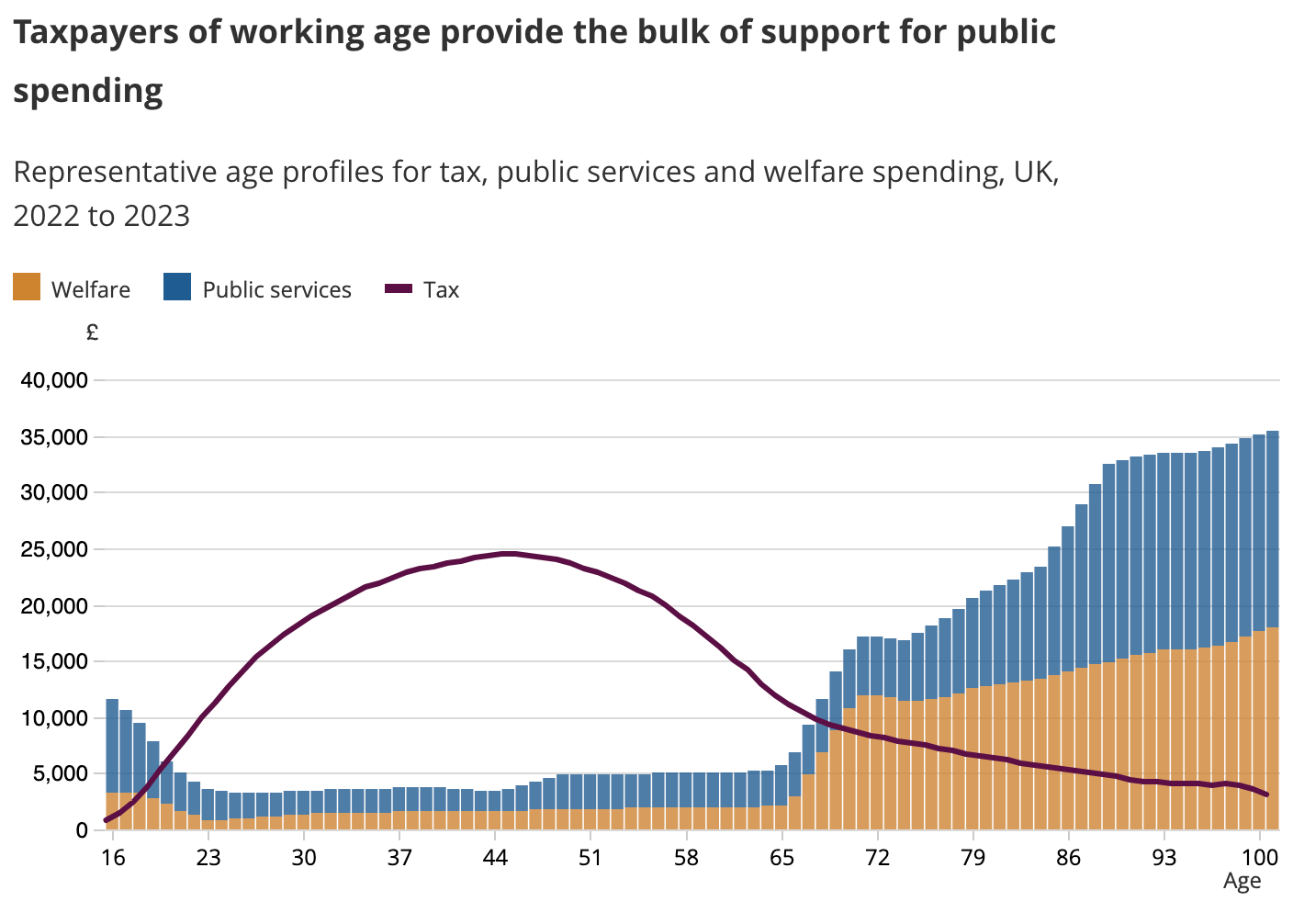

State pensions are paid out of current tax receipts; which means working people are taxed and some of that tax is then paid out to people in receipt of the state pension:

Rather than a ring-fenced pot, the state pension is more akin to a social contract.

Workers support pensioners via the state pension (a wealth transfer from the young to the old) to help ensure everyone, quite rightly, has some level of dignity in retirement and, by doing so, they hope/expect that they’ll be afforded the same level of state care when they’re old…

The problem is, people are having fewer babies (less future workers) and aren’t dying as promptly as they used to (more old people); therefore, fewer workers have to support an increasing number of old people:

So, something will have to give in the future (e.g. the triple lock/further increases to the entitlement age/means testing the benefit).

Anyway, I digress…

Types of Income

In the UK, income tax and NI apply to some types of income but not to others.

You pay income tax on:

Earned income (via PAYE).

Rental income.

Self-employed profits.

Pension income (sometimes).

You don't pay income tax on:

Income from an ISA.

Lottery winnings.

Premium bonds.

Dividends (they have their own tax rates, detailed below).

You pay NI on:

Earned income (via PAYE).

Self-employed profits.

You don't pay NI on:

Any other income.

Personal Allowance

Everyone starts each tax year with a standard personal allowance of £12,570, which is the amount of taxable income you can earn tax-free each year.

For some, their personal allowance can be increased/decreased/removed; however, we'll avoid much of these technical aspects for now.

Taxed by Stealth

The personal allowance and income tax bands had been increasing each tax year, to account for inflationary rises to wages over time; however, in April 2022 the government (when Rishi Sunak was Chancellor) froze the personal allowance and income tax bands until April 2028.

At the time, they expected it to raise an additional £8bn a year.

Due to higher than expected inflation pushing up wages, more people are now paying more tax as they are pushed into the higher/additional rate tax bands.

The result of which is a new estimate of an additional £32bn a year.

An additional £32bn per year in income tax receipts3, all without ‘putting up taxes’.

That, ladies and gentlemen, is what we call a stealth tax (or ‘fiscal drag’).

Income Tax

Let's have a look at the (currently frozen) tax bands for England, Wales and Northern Ireland4, using a trusty bucket illustration:

As you can see, UK income tax is tiered.

We only pay the specified tax rate on the amount of income that falls into a particular band:

0% on the first £12,570.

20% on the next £37,700.

40% on the next £74,870.

45% thereafter.

If you’re a part of the workforce (and under state pension age), then you’ll likely be paying NI; which, as noted earlier, is really just a second income tax. You pay 8% NI in the basic rate band, then it’s capped at 2% for the higher and additional rate bands.

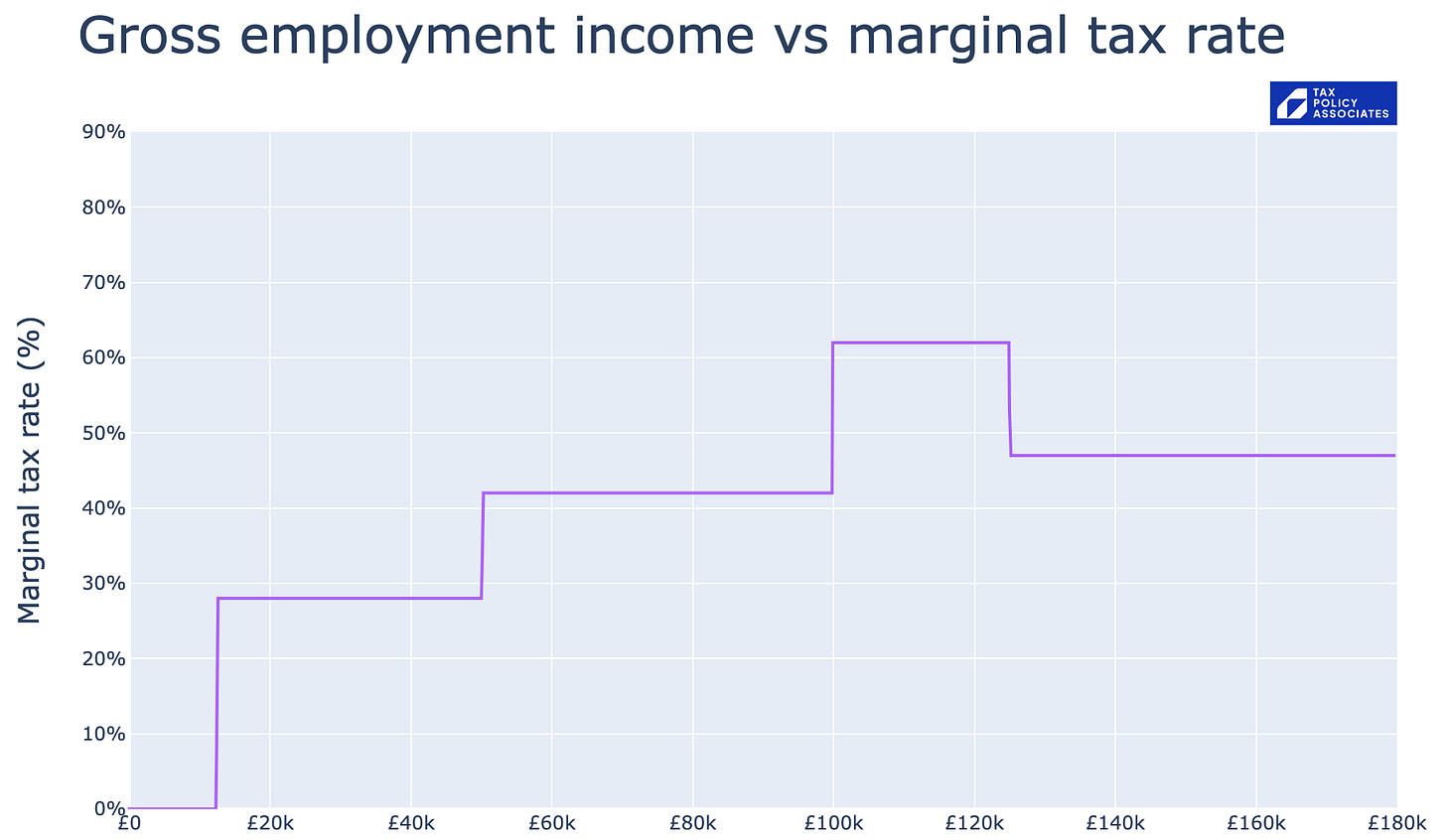

Therefore, the easiest way to think about your personal tax position on earned income is to add income tax and NI together:

0% on the first £12,570.

28% on the next £37,700.

42% on the next £74,870.

47% thereafter.

Let’s look at a simple example of an employee on a salary of £60,000:

Now, an example of a pensioner who needs £60,000 of income (they have full state pension entitlement and a rental property bringing in £20,000 gross income per annum… which is split between their remaining Personal Allowance and the basic rate tax band):

The above examples serve to illustrate how different types of income are treated differently.

If the employee also had rental income, that would be taxed in the same way as the pensioner’s rental income. As would any ISA withdrawals.

The only difference would be if the pensioner still worked, their earned income would not be subject to NI (as you stop paying NI once you reach state pension age).

Dividend Tax

Whilst the same tax bands apply, dividends are taxed at a lower rate to earned income:

Basic rate = 8.75%

Higher rate = 33.75%

Additional rate = 39.35%

In 2024, the first £500 of dividends received are tax-free (this is the dividend allowance).

Business owners routinely draw a lower salary and then top up their income via dividends, as it's more tax efficient.

Let’s look at a business owner who wants their total pay to be £60,000.

In practice, this is where it gets a bit more complicated with NI. There are thresholds that can be met which means the business owner doesn’t pay any NI personally, but still receives qualifying years for their state pension (hence the £9,100).

Quite the difference from the worker on a salary of £60,000!

However, dear worker, please remember:

The business owner has likely taken on significant levels of risk.

They probably employ people; therefore, their business will pay ‘employer NI’.

The company’s profit is subject to corporation tax (at either 19% or 25%).

Four Tier System

So, the UK tax system effectively has four different tiers for income tax:

PAYE income: 28% / 42% / 47%.

Self-employed income: 26% / 42% / 47%.

Most other income (pensions, rental income etc.): 20% /40% / 45%.

Dividend income: 8.75% / 33.75% / 39.35%.

No one is restrained to one tier, in reality many of us will have income that falls into two or three of them.

And here’s the kicker…

These are just the headline rates of tax, there’s a whole host of marginal rate tax traps (60%+) created by years of layered legislation and political parties who don’t seem to understand what they are meddling with… case in point:

Marginal Rate Tax Traps

I’m going to keep this section simple(ish), as it can get confusing/ridiculous (see above) once you add in high income child benefit charges, multiple children and student loans.

If this section tickles your pickle, then I’d suggest reading this from Tax Policy Associates for a deep dive and also to follow Dan Neidle on X (formerly Twitter).

We’ll stick with looking at the most notorious tax trap in the UK…

The 62% Tax Trap

Whilst the headline income tax rate only goes up to 47% (inc. NI), you could end up paying an effective rate of 62% (inc. NI) on a portion of your income:

How does this happen?

It comes down to the Personal Allowance.

Within our tax rules, it states:

Your Personal Allowance goes down by £1 for every £2 that your adjusted net income is above £100,000.

This means your allowance is zero if your income is £125,140 or above.

-HMRC

Losing your Personal Allowance results in more of your taxable income falling into the basic rate band (20%).

HMRC effectively take 62p from every £1 you earn between £100,000 to £125,140.

Let's look at an example of an employee earning £120,000:

Due to earning £20,000 over £100,000, their Personal Allowance has dropped to £2,570; resulting in an extra £10,000 being pushed into the basic rate tax band.

Regaining the Personal Allowance

Now, it's not all doom and gloom; there is something our working protagonist can do to reclaim their Personal Allowance…

As luck would have it, our worker has £16,000 cash in the bank.

If they contribute that £16,000 into a pension, their adjusted net income will be reduced to £100,000 - reviving their Personal Allowance to £12,570!

Why only £16,000 and not £20,000?

Good question!

Personal pension contributions attract tax relief from HMRC (20%), so the £16,000 contribution would benefit from £4,000 tax relief - bringing the total contribution to £20,000 (this process is referred to as 'grossing up').

To top it off, as a higher rate payer they can claim another 20% tax relief via self assessment:

For a £16,000 pension contribution, they’re left with a lower tax bill (£14,600 saved) and more money invested for their future (£20,000) - that’s a pretty great deal!

ISAs & Pensions

A quick note on ISAs and pensions and how they relate to tax.

ISAs:

Any money you put into an ISA is sheltered from income tax and capital gains tax.

However, beware those who say an ISA is 'tax-free' - that is incorrect!

An ISA is still subject to inheritance tax (IHT).

Pensions:

25% of the pension pot is tax free (sometimes this can be higher).

75% is subject to income tax (but only at the point of withdrawal).

Money within a pension is not subject to IHT.

Pensions are complex, it’s usually best to seek advice.

It Depends…

Please note, all of the above examples are simplified and the information provided throughout is generic.

Whilst you, on the other hand, are neither simple nor generic.

Therefore, do not take action without close consideration of your own unique circumstances. If in doubt, seek help from a qualified professional of your choosing.

Life isn’t always as simple as just popping £X into a pension.

The real answer will always be, It Depends…

Ready to secure your financial future?

Clicking the button will generate a contact form.

We'll then have an initial conversation to better understand your needs/wants/aspirations and to see whether my services would be a good fit.

Thanks for reading,

Tom Redmayne

Chartered Financial Planner

If you enjoyed the article, please consider sharing it with someone else who’d also enjoy it or more widely on social media, it really helps:

Don’t forget to subscribe, so you can get future articles directly to your inbox!

This is not personal advice based on your circumstances.

All views are my own.

Links

Income Tax calculator - click here.

Income Tax rates and Personal Allowances - click here.

Taxable income - click here.

Tax on savings interest - click here.

Tax on dividends - click here.

Intro to National Insurance - click here.

Adjusted Net Income - click here.

Tax Policy Associates - click here.

Taken from Paul Johnson’s book, Follow The Money.

https://obr.uk/forecasts-in-depth/tax-by-tax-spend-by-spend/welfare-spending-pensioner-benefits/#:~:text=The%20state%20pension%20is%20the,the%20total%20in%202023%2D24.

https://researchbriefings.files.parliament.uk/documents/CBP-8513/CBP-8513.pdf

The Scots have their own tax brackets and felt the need to add more of them!