Single Points of Failure (SPOF)

Is your lifestyle exposed to a SPOF?

To support the publication and receive new articles directly to your inbox, please subscribe:

If you’ve already subscribed but haven’t seen the emails, please check your junk/spam!

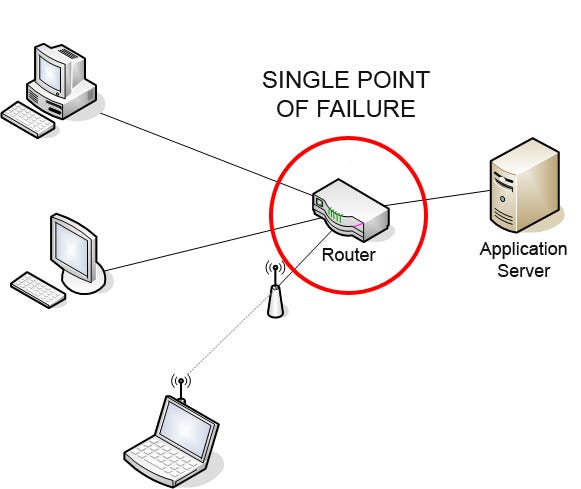

What is a Single Point of Failure (SPOF)?

A SPOF is any aspect of a system that, if removed, brings down the entire system.

For example, if a business only has one wireless internet router, they’ll cease to operate if it malfunctions - leaving their expensive staff twiddling their thumbs.

If the only bridge across a river collapses, then there goes a lot of supply chain networks that had been operating on either side of said bridge.

So, how does this apply to your personal finances?

Financial SPOF

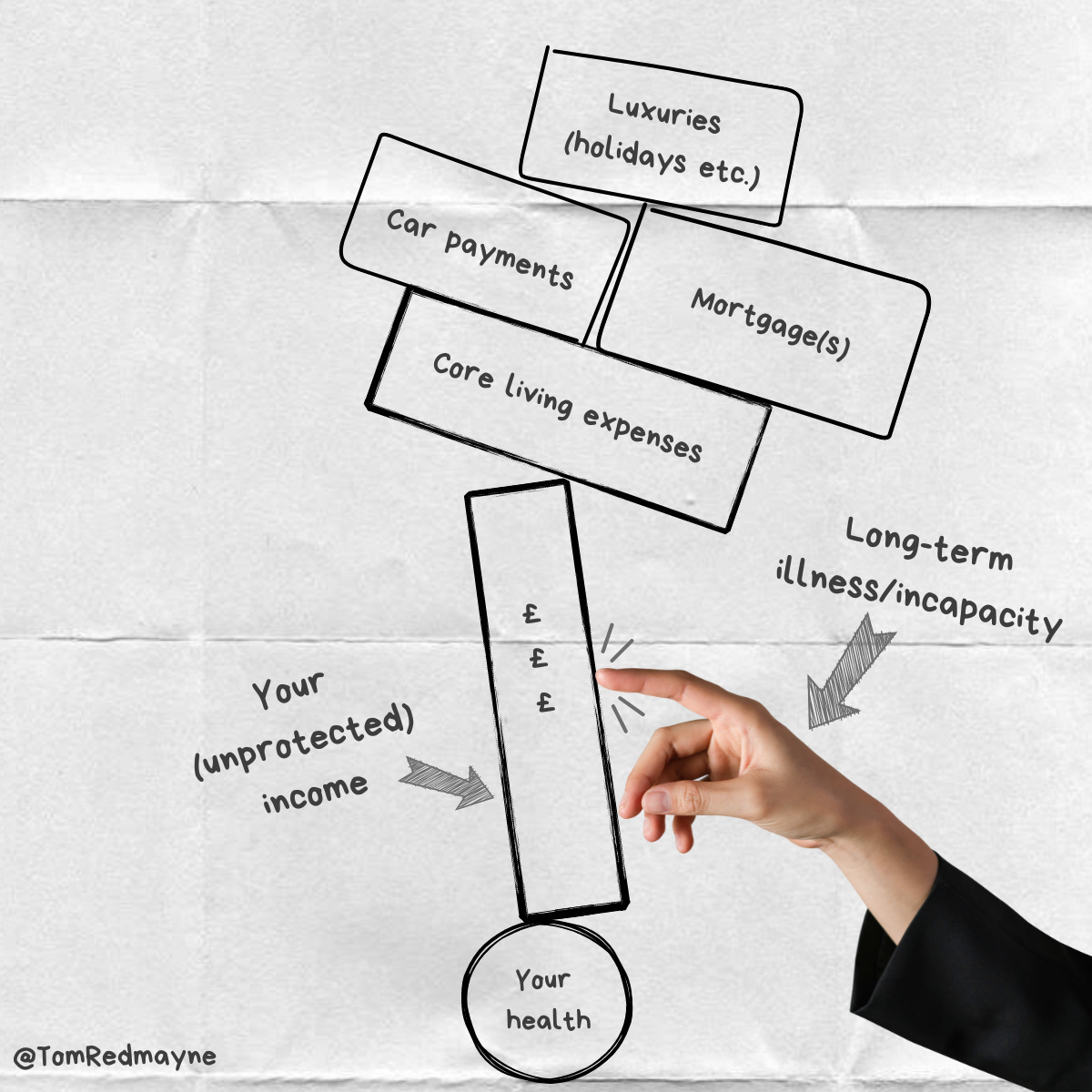

A financial SPOF is any aspect of your personal finances that, if removed, brings down your entire lifestyle.

For most households of working age, their earned income is a SPOF.

During our working lives, our lifestyle is (typically) solely dependent upon our ability to continue earning income.

Our ability to earn is known as our ‘human capital’ and it’s a working person’s greatest financial asset.

Why?

We leverage our earned income to take out mortgages.

We feed our children via earned income.

We pay our rent via our earned income.

We heat our homes via earned income.

We go on holiday via earned income.

We invest via earned income.

The list goes on.

Yet, only 6.1% of adults insure their income - whilst 29% insure their lives1.

If you do not protect your ability to generate an income, then yours and your family’s lifestyle is likely exposed to a large, single point of failure:

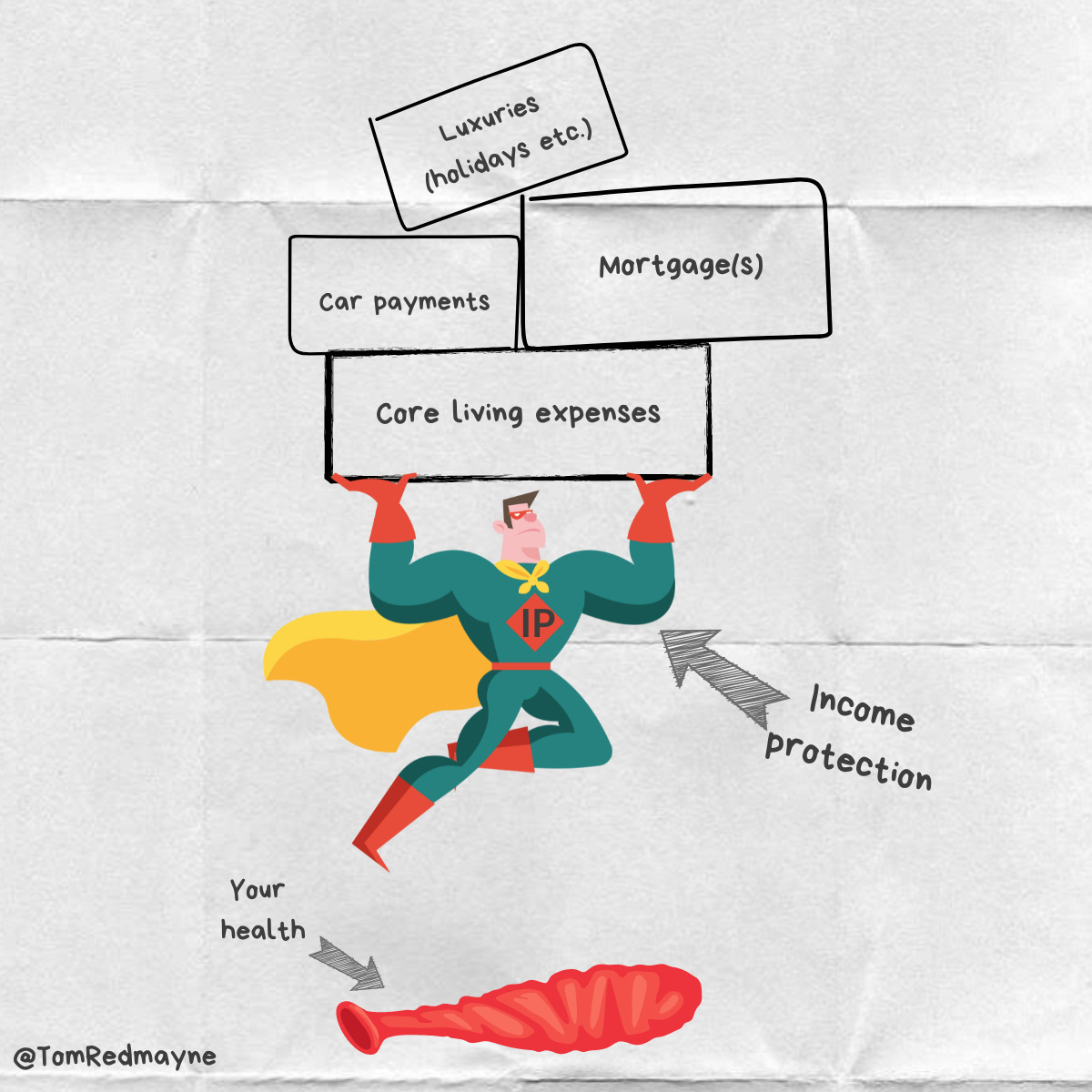

Is it a Bird? Is it a Plane? NO!… It’s Income Protection!!

Income protection is designed to swoop in and save the day when you can’t work, and therefore earn, due to prolonged ill health.

The regular income payments from the policy are intended to help you prop up your lifestyle costs; so you can focus on your recovery in (relative) peace.

The policy can pay up to 60% of your income (or more if it’s executive cover) until you are either:

fit enough to work again.

reach retirement age.

(It won’t pay 100% of your income as that disincentives you to go back to work).

Key bits:

There’s typically a deferment period of 13 weeks before the payments start (this can be shorter or longer and will depend upon your employer’s sick pay policy).

It can also cover your National Insurance (NI) payments; if you were unable to work until retirement age, you’d still be eligible for the full state pension (which would be handy, as the income protection payments would’ve stopped!).

The same applies for private pension contributions (these added extras increase the monthly premium).

For more info, speak to a professional or have a good gander on Google.

What’s the Alternative?

If you’re employed, you’ll - at a minimum - receive Statutory Sick Pay (SSP).

You can get £116.75 per week Statutory Sick Pay (SSP) if you’re too ill to work. It’s paid by your employer for up to 28 weeks.

-HMRC

Safe to say, that won’t get you far nowadays!

Risking it for a Biscuit

If you protect your life but not your income, you are engaged in a gamble where the odds are not in your favour.

If you are of working age, you’re much more likely to experience long-term sickness than you are to die.

Here are my stats from July 2024 until age 65 (I’m a 32 year old non-smoker)2:

37% chance of being unable to work for two months or more.

13% chance of suffering a serious illness.

4% chance of dying.

42% chance of any of the above happening.

(Check out your own stats here).

As my probability of dying before age 65 is only 4%, it doesn’t make sense for me to only insure my life - which is why I have life insurance and income protection.

Based on the above probabilities, it is worrying how few working people insure their greatest financial asset (their ability to earn); thus also turning it into their greatest liability.

Waste of Money!

A common reason not to buy insurance is the perception that it’s a waste of money.

I agree.

For most, it (hopefully) will be.

If you are fortunate enough to avoid ill-health and/or an early demise before retirement, then it’ll have been a waste of money (minus the peace of mind provided).

Personally, I really hope I’m wasting my money each month!!

However, if a misfortune should befall me, then it’ll be worth its weight in gold for me and my family.

Other SPOFs

Losing your ability to earn due to a prolonged illness/injury isn’t the only way you could face a financial SPOF.

Here is a non-exhaustive list of other potential SPOFs:

Insufficient assets invested to outpace the negative effects of inflation on your money’s purchasing power (leaving you unable to sustain your desired lifestyle throughout retirement).

Losing your job (income protection can’t help you here… but savings can).

A spiralling debt burden you can no longer afford to service.

A large, unexpected expense with no savings to cover it.

Closing Thoughts

We protect our cars.

We protect our lives.

We protect our homes.

We protect our possessions.

So, why don’t we protect our income?

After all, everything else depends on it…

If you enjoyed the article, please consider sharing it with someone else who’d also enjoy it or more widely on social media, it really helps:

Don’t forget to subscribe, so you can get future articles directly to your inbox!

Thanks for reading,

Tom Redmayne

Chartered Financial Planner

This is not personal advice based on your circumstances… as always, It Depends.

All views are my own.

https://www.fca.org.uk/publication/financial-lives/fls-2022-general-insurance-protection.pdf

https://riskreality.co.uk/gen

Great illustrations as well !

Great stuff Tom. Such an important message!