The first one of these came to me in a dream - a bit like McCartney dreaming the tune for Yesterday… right?

It’s almost as if I was a vessel for a higher power!

I am now on the lookout for a burning bush...

1. Thou shall not speculate on the short term price movements of assets with money thou cannot afford to lose

Speculating is not investing, it’s gambling.

It doesn't matter how many fancy screens you have, the hours you've spent analysing candlesticks and tweets or the amount you’ve paid for some dodgy trading course, it’s a different game to investing.

You are simply betting on which way the price of an asset will go - which, as detailed in the next commandment, you cannot know the outcome of without a crystal ball.

Investing, on the other hand, is curating a diversified portfolio of assets that are suitable for your needs and then holding them over the long term - whilst ignoring short term movements in price.

By all means, have a flutter on the side. But don’t risk your financial future by gambling with money you cannot afford to lose!

Rule No. 1: Never lose money.

Rule No. 2: Never forget Rule No. 1.

Warren Buffet

2. Thou shall not attempt to time the market, unless thou has a functioning crystal ball

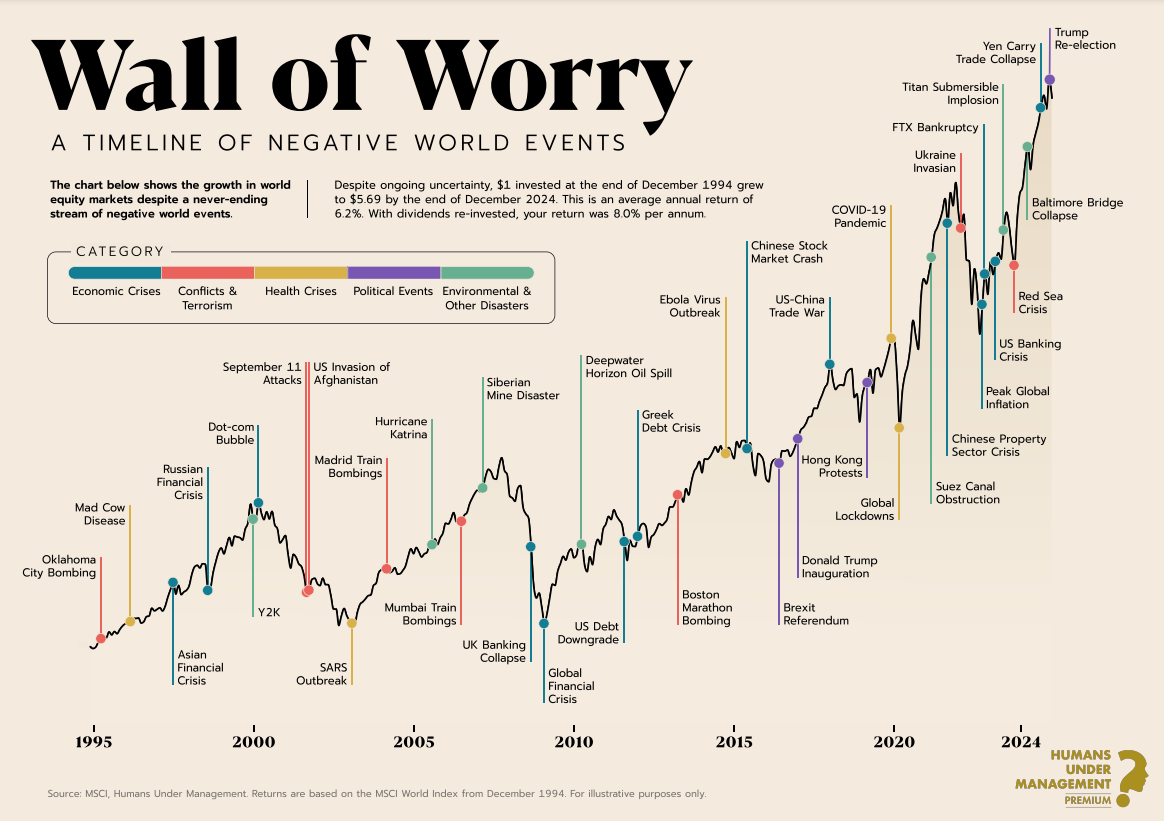

The future is - by its very nature - unpredictable.

Stock markets have a habit of not doing what you expect.

No one can predict with any certainty as to what will happen next.

Whilst tempting, we have to try and avoid making predictions.

Even worse than making your own predictions, please don’t be swayed by others!

Financial pundits constantly cry wolf. Remember, a broken clock is right twice a day and there is - on average - a 10% downturn each year, so they'll eventually 'be right'.

There is only one prediction I will make:

"Stock markets will be higher in 20 years time than they are now"

Tom Redmayne

Feel free to quote me on that!

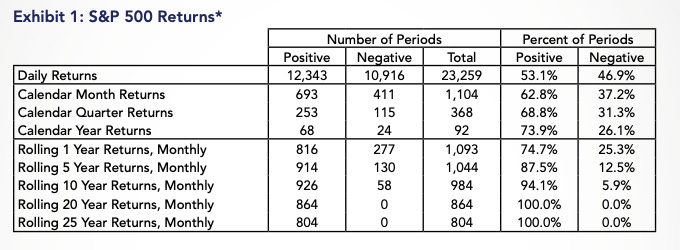

The reason I make this prediction is because the historical evidence shows us that it has always been the case:

Over any 20 year period the stock market has achieved positive growth, as detailed above.

In any 1 year period, the S&P 500 is up c.75% of the time.

3 out of 4 years are typically positive.

In any 10 year period, it’s positive c.94% of the time.

Once you hit 20 years, it is 100% positive across any 20+ year period.

Those 20+ year periods include, but are not limited to:

Vietnam

World War 2

Tech bubbles

High inflation

The Great Depression

The Global Financial Crisis

3. Thou shall not invest large portions of thine wealth into non-productive assets

If you want to build real wealth, then your money needs to be working for you; therefore, you need to avoid mainly holding non-productive assets and invest in productive assets.

Gold, for example, has never worked a day in its life, it’s just sat around for three billion years.

It doesn’t compound.

It doesn’t generate income.

It doesn’t produce anything at all.

It just sits around being scarce.

Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.

Warren Buffet

Global equities, on the other hand, work for you 24/7, 365. They are real businesses providing real products and services to real people (me and you included).

They provide a rising income and rising capital value over time and, most importantly, the ability to compound one’s wealth.

Don’t let your money languish in non-productive assets.

Put it to work.

I’m just going to leave this here…

(I’m picking on gold to make the point, as it can be easily tracked, there are many other non-productive assets people invest in - some much more questionable than lazy ol’ gold).

4. Thou shall not buy high, sell low

This one should be obvious but we’re emotional creatures.

It’s important to understand that being irrational is in our nature. Once you acknowledge this, it becomes easier to stop yourself making emotional errors.

As investors, we are often our own worst enemy.

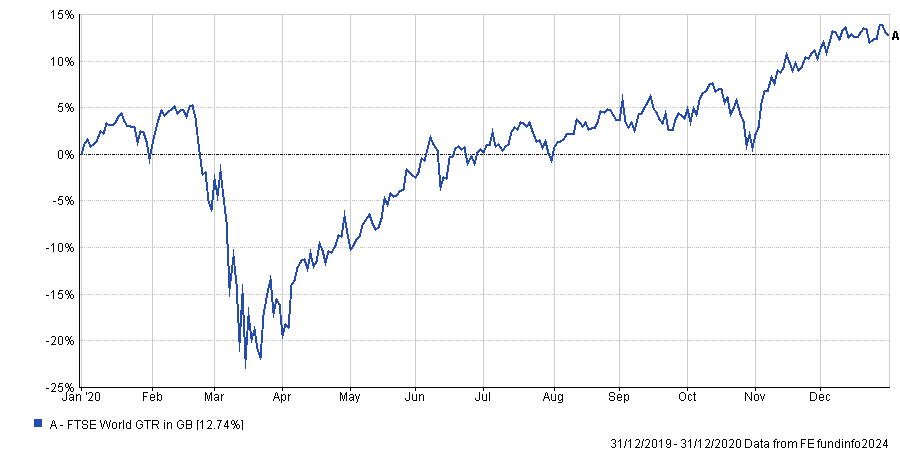

For example, I was working at HL during the crash of 2020 and spoke to multiple people who sold on the way down.

They all said something similar:

I’ll sell now, then buy back in when the market recovers

HL Clients

They acknowledged to me that the market would recover, but the emotional pain was too great! They’d rather sell when the market was low and buy back in when it was higher… and higher it went!

Yes, it’s completely irrational; however, if you empathise with someone seeing their assets plummet by 30% (which they might be reliant on for income), it is emotionally understandable.

Whilst understandable, it’s our job as investors to not allow our emotions to lead us towards financial ruin.

Buying high and selling low is financially destructive.

For example, if you sold at a 50% loss, you then need a 100% gain to get back to breakeven. The maths isn’t on your side with this one.

If you find yourself wanting to sell during a crash, please take a step back and... breath.

Remember, all market declines are temporary - they are baked into the stock market experience.

If you look back across history, you will see that a market decline is often followed by the stock market reaching new heights…

Hold sufficient cash for emergencies and prolonged downturns (so you don’t have to sell into a down market).

Don't look at your portfolio if you can help it.

Hold tight.

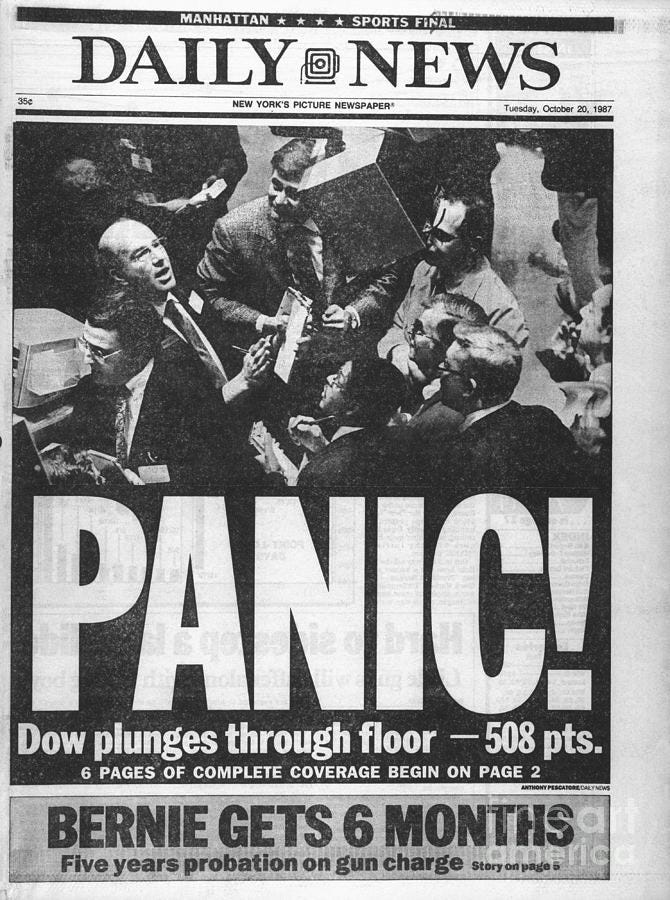

5. Thou shall not pay attention to - or act upon the ‘advice’ of - the fear mongering media

Fear sells.

Negativity sells.

We know this.

Media companies are not on our side.

How do we know this?

They’re always quick to report when £X billion is ‘wiped off’ the stock market, but always seem to forget to mention when it’s ‘wiped back on’.

Delete their apps from your phone, keep your eyes downcast in a petrol station forecourt and generally avoid the negativity they constantly pump out (easier said than done, I know).

Doing so is almost guaranteed to make your life more pleasant!

Say a prayer for the folk who - irreversibly - withdrew the tax-free cash from their pensions before Reeve’s October 2024 budget - another potentially financially ruinous decision whipped up by media speculation.

6. Thou shall not be a sheep, forever following every trend

GameStop. Meme stocks. Crypto shitcoins. NFTs (what happened to those?!). Squeezing silver. Peleton. Oil and mining shares.

Trends are financially destructive.

If you are chasing someone else’s past gains or acting on a third party tip then you are too late!

To quote Margin Call:

Be first, be smarter or cheat

The guy from Margin Call

The first two are near impossible to do and good luck with the third one - I wouldn't recommend it!

If you chase every trend you’re actually chasing your own financial ruin, and I’m afraid you might just find it.

Ignore the noise.

Don't give in to FOMO.

Stick to a sensible, evidence-based plan that’s specific to your needs.

7. Thou shall keep costs down, whenever reasonable to do so

Investment costs are a drag on return. The costs you pay to invest will reduce your return. The main costs to be aware of are:

Fund charges (inc. transaction costs).

Platform charges.

The more you pay, the less money you have working for you - this is negative compounding in action.

In every single time period and data point tested, low-cost funds beat high-cost funds

Morningstar

Lets look at the impact of investment costs on £100k over 30 years with an annual 7% (nominal) return:

1% annual charge = £575,350

0.35% annual charge = £689,951

Difference = £114,601

That's a lot of extra money to spend on whatever is important to you!

Please note, not all costs are created equal, as some online would have you believe...

You may’ve noticed I didn’t include advice fees in the list of investment costs.

Financial advice is not an investment cost.

It’s an ongoing, professional service, which should be adding, rather than detracting, value. Here’s a non-exhaustive list of ways in which it does so:

Asset allocation advice (which can determine up to 90% of your return).

A barrier between you and financial mistakes/scams.

Tax-efficient income/saving/retirement planning.

Support for a surviving spouse.

Accountability.

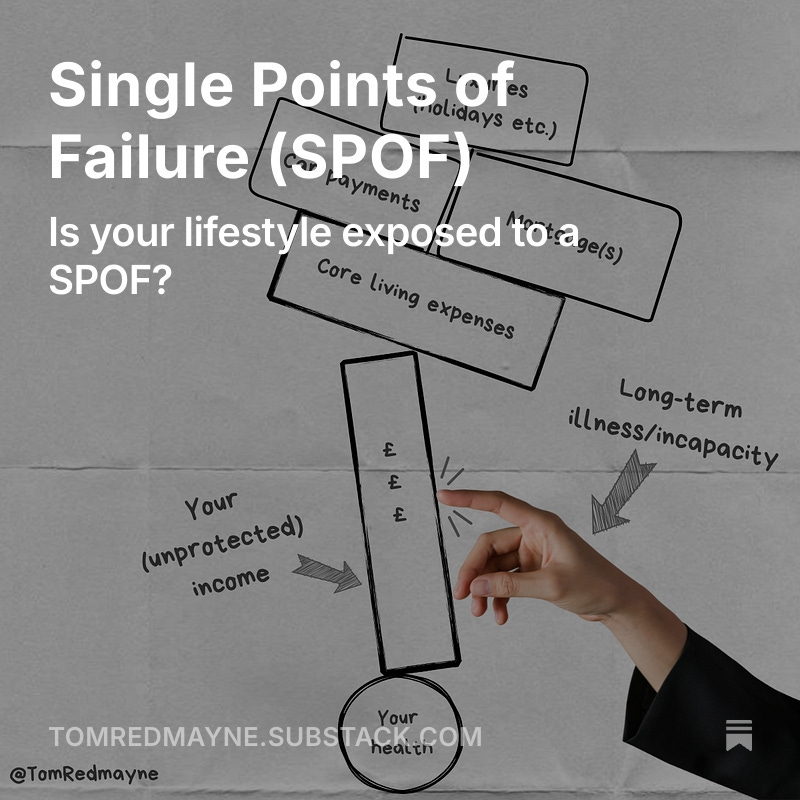

8. Thou shall protect thine income

During our working lives, our lifestyle is (typically) solely dependent upon our ability to continue earning income.

Our ability to earn is known as our ‘human capital’ and it’s a working person’s greatest financial asset.

Why?

We leverage our earned income to take out mortgages.

We feed our children via earned income.

We pay our rent via our earned income.

We heat our homes via earned income.

We go on holiday via earned income.

We invest via earned income.

The list goes on.

Yet, only 6.1% of adults insure their income - whilst 29% insure their lives.

If you do not protect your ability to generate an income, then yours and your family’s lifestyle is likely exposed to a large, single point of failure.

Click here for the full article…

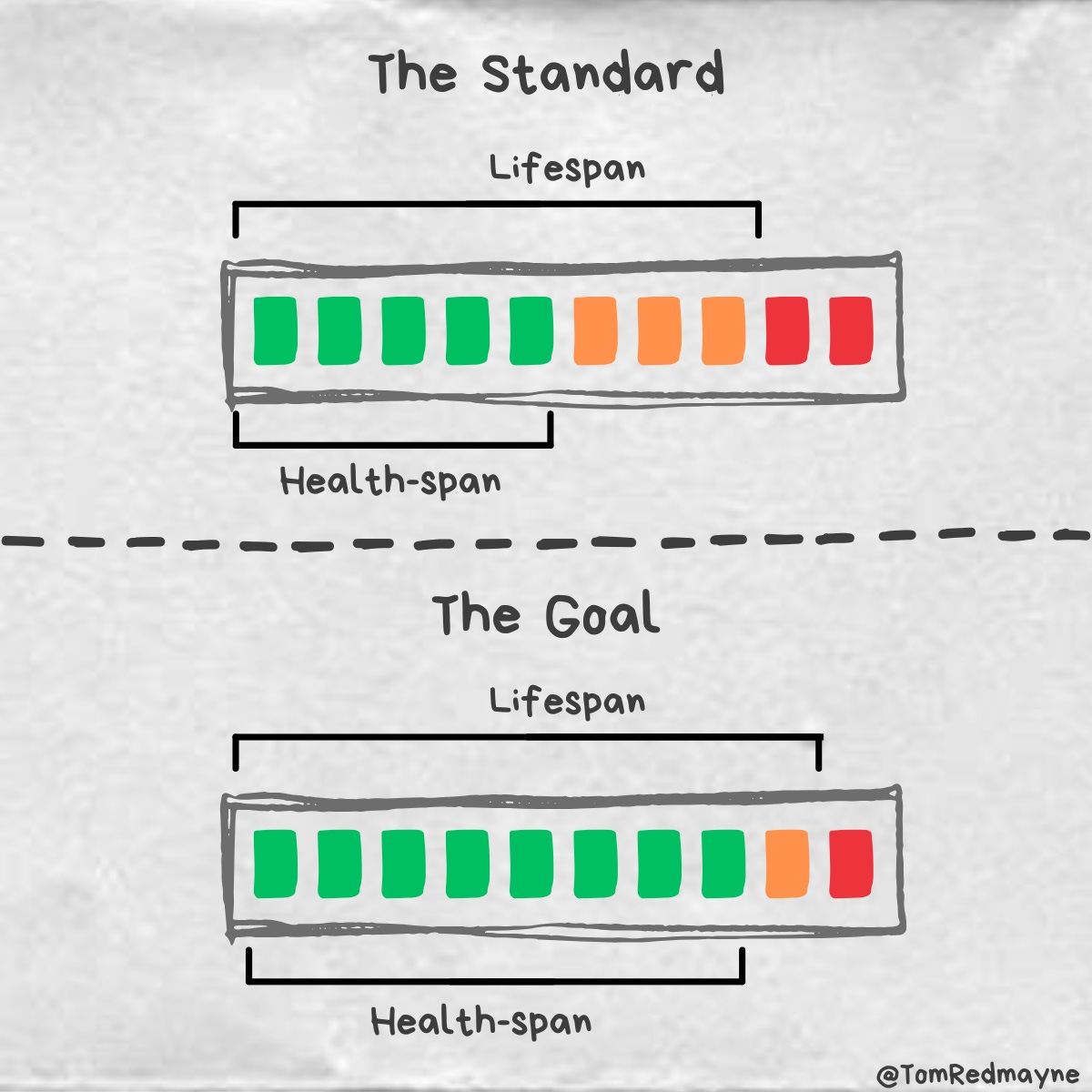

9. Thou shall view thine health as an investment

Spending money on your health and wellbeing is an investment not a cost.

When planning for the future, many people focus solely on lifespan - the number of years they expect to live.

But there’s another crucial factor to consider: your health-span.

This is the period in your life when you’re not just alive, but healthy and active enough to truly enjoy it.

For many, the idea of a long life is appealing, but living longer doesn't always mean living well.

Medical advances may help us live into our 80s and 90s, but without good health, those extra years could be spent dealing with chronic illness and/or restricted mobility (‘tedious’ is putting it lightly).

Typically, we run out of health before we run out of life.

Therefore, the goal is to align your health-span as closely as possible to your lifespan - so you’re able to enjoy the activities that matter most to you throughout your life.

Spending money on increasing your health-span is a bloody good investment in my book!

10. Thou shall enjoy today, knowing tomorrow is taken care of

Do not needlessly waste hours of your life obsessing over investing.

There is more to life than money and there’re no pockets in shrouds.

Money is simply a tool to help you live the life you want to live. Investing helps to ensure you have enough money to do so until your dying day!

Decide what a good life looks like to you, get your investments set up correctly to support said life, then go and live it - whilst your investments tick away in the background.

Ready to secure your financial future?

Based on your answers to the questionnaire, I’ll send you a free, no obligation, video response with a personalised financial health check to let you know if you’re on track for your desired financial future.

Thanks for reading,

Tom Redmayne

Chartered Financial Planner

This is not personal advice based on your circumstances.

All views are my own.