The Divine Dividend

A key ingredient for wealth creation.

To support the publication and receive new articles directly to your inbox, please subscribe:

Not a scam…

Greetings,

Do you want to receive a portion of $1.66 trillion?

Please reply urgently, I’m a Nigerian Prince looking to transfer my fortune out of the country…

“Yes!”

“But how?!”

Well, $1.66 trillion is the amount of dividends paid out to equity investors in 2023.

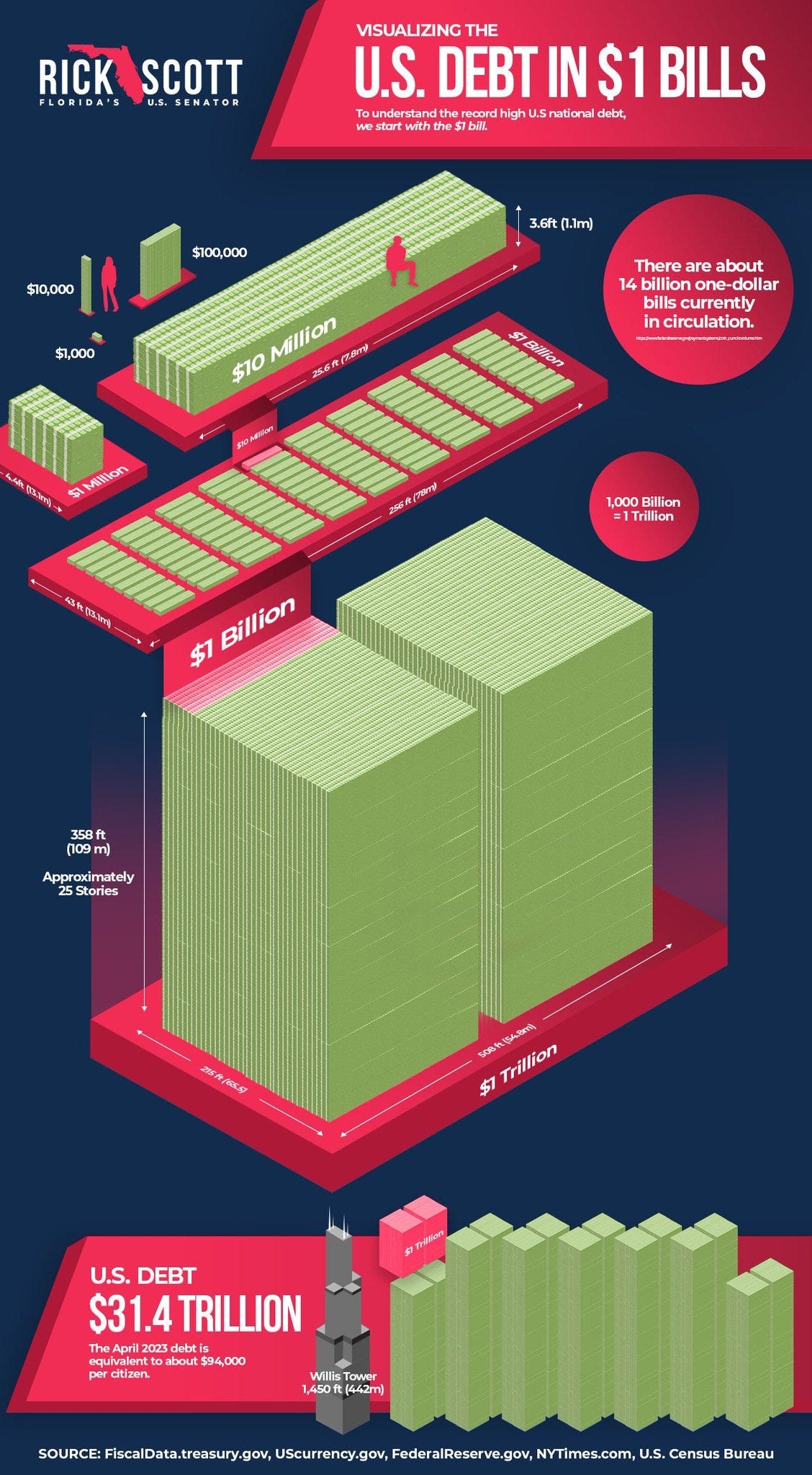

How much is a trillion dollars?

Enough to make your head spin!

It’s a million million, or a thousand billion; it has 12 zeros…

$1.66tn = $1,660,000,000,000.

Here’s a handy visualisation from a US politician, Rick Scott, which he was using to illustrate the mind-boggling level of government debt in the US:

What are dividends?

If you invest in equities, then you are a partial owner of publicly listed companies; which makes you entitled to a share of their profits (AKA dividends).

Not all companies pay out dividends. It depends on a range of factors. Investors in some companies, such as Amazon, don’t want a dividend. They want the company to reinvest all profits for future growth. Whilst a mature company with less room for growth, such as Lloyds Bank, will routinely share their profits with investors in the form of a dividend.

Free lunch?

A common misconception is that dividends are free money, created out of thin air; which is known as the ‘free dividend fallacy’.

Whilst dividends are great, they are not free money.

When a company pays out a dividend, their stock price drops by the same amount (as they are releasing capital out of the business).

It’s what you do with the dividends that matters…

The Divine Dividend

Dividends are what makes investing in equities such a force for wealth creation!

Not only do you benefit from the capital appreciation in value over time, you also benefit from a rising dividend income over time.

Even in 2022, when 'the markets' provided a negative return, over a TRILLION dollars of dividends was still paid out to investors:

Remember, ‘equities’ are real companies.

They’re the companies providing the goods and services to the world’s population in exchange for, hopefully, making a profit. They are what make our modern life possible.

Even when the stock markets are temporarily down, these companies continue to operate. Life doesn't stop just because their valuations have temporarily declined; although the media might make you think otherwise!

The stock is not the company, and the company is not the stock.

-Jeff Bezos, Founder of Amazon (in case my mum doesn’t know him)

We still need our avocados to be grown, harvested, sorted, transported, distributed and sold to us every day. Every time we eat, drink, sit, walk, work or sleep, you can bet a public company (AKA an ‘equity’) was probably involved in some way.

Investing in equites makes you are a part-owner of real companies - thus making you entitled to a slice of their profits.

Once companies have reinvested some of the profits for future growth, they often pay out the remaining profits to shareholders in the form of a dividend.

This is what makes equities a highly productive asset to own.

Pocketing v.s. Reinvesting

This decision is important.

Do you pocket the dividend income or reinvest it?

Taking dividend income used to be quite a common strategy; however, reinvesting dividends has become much easier and more prevalent over time.

If you reinvest dividend income into more equities (an accumulation fund does this for you automatically), you begin to benefit from the wonders of compound interest and exponential growth over time:

Capitalism + compounding is a beautiful thing 🤌

How does it work?

In the UK, we often invest via funds.

A fund is a pooled investment vehicle; in which investors put their money together and a professional fund manager invests it on their behalf.

By doing so, the fund can benefit from economies of scale when purchasing assets and allows for a more hands off approach for retail investors.

Investing within a fund makes you a partial-owner of the assets held within it.

There are two main types:

Income fund = any income generated from the assets is paid out to the investors.

Accumulation fund = any income received from the assets is used to buy more assets within the fund (equities, bonds etc.).

Investing in an accumulation fund is where the magic of compounding happens.

Here’s an example:

You invest into an accumulation fund1.

Some of the underlying assets generate an income.

That income is used to buys more assets.

The fund now holds more assets; increasing the amount of future income that can be received to buy even more assets.

Some of the underlying assets (which there are now more of) generate an income.

That income is used to buys more assets.

The fund now holds more assets; increasing the amount of future income that can be received to buy even more assets.

Rinse and repeat for eternity ♻️

Said another way:

Assets generate income > Income buys assets > More assets generate more income > More income buys more assets > More assets generate more income ♻️

If you enjoyed the article, please consider sharing it with someone else who’d also enjoy it or more widely on social media, it really helps:

Don’t forget to subscribe, so you can get future articles directly to your inbox!

Thanks for reading,

Tom Redmayne

Chartered Financial Planner

This is not personal advice based on your circumstances.

All views are my own.

If you’re an employee in the UK, you are likely already invested in an accumulation fund(s) as part of the default investment choice within your workplace pension scheme… if so, this is already happening for you.