To support the publication and receive new articles directly to your inbox, please subscribe:

The mere mention of Inheritance Tax (IHT) over a few shandies is bound to get a visceral response - even from those who are never going to pay it.

It is a widely misunderstood tax, with many believing it touches everyone ; however, only c.5% of estates actually pay IHT1.

Personally, I’m not a fan of IHT. I think we are taxed a sufficient amount during our lifetimes and people should be able to bequeath their remaining worldly assets to their heirs - if they wish to do so - without the state taking one final slice.

Professionally, I deal with the world as it is, not as I may wish it to be. There are many ways to manage and mitigate IHT, some more complex and costly than others, which we’ll touch upon in this article.

In this article we’ll run through:

What is IHT?

The shifting goalposts.

How to make informed IHT decisions.

Some of the ways to mitigate it.

The best legacy you can leave behind.

An IHT planning checklist to get you started.

A word on cost, value and inaction.

Disclaimer: IHT is a complex topic with a lot of nuance and caveats. I’ll start the next section by writing ‘typically’ to make the point, then stop doing so for brevity. Take ‘typically’ as applicable to most statements.

What is IHT?

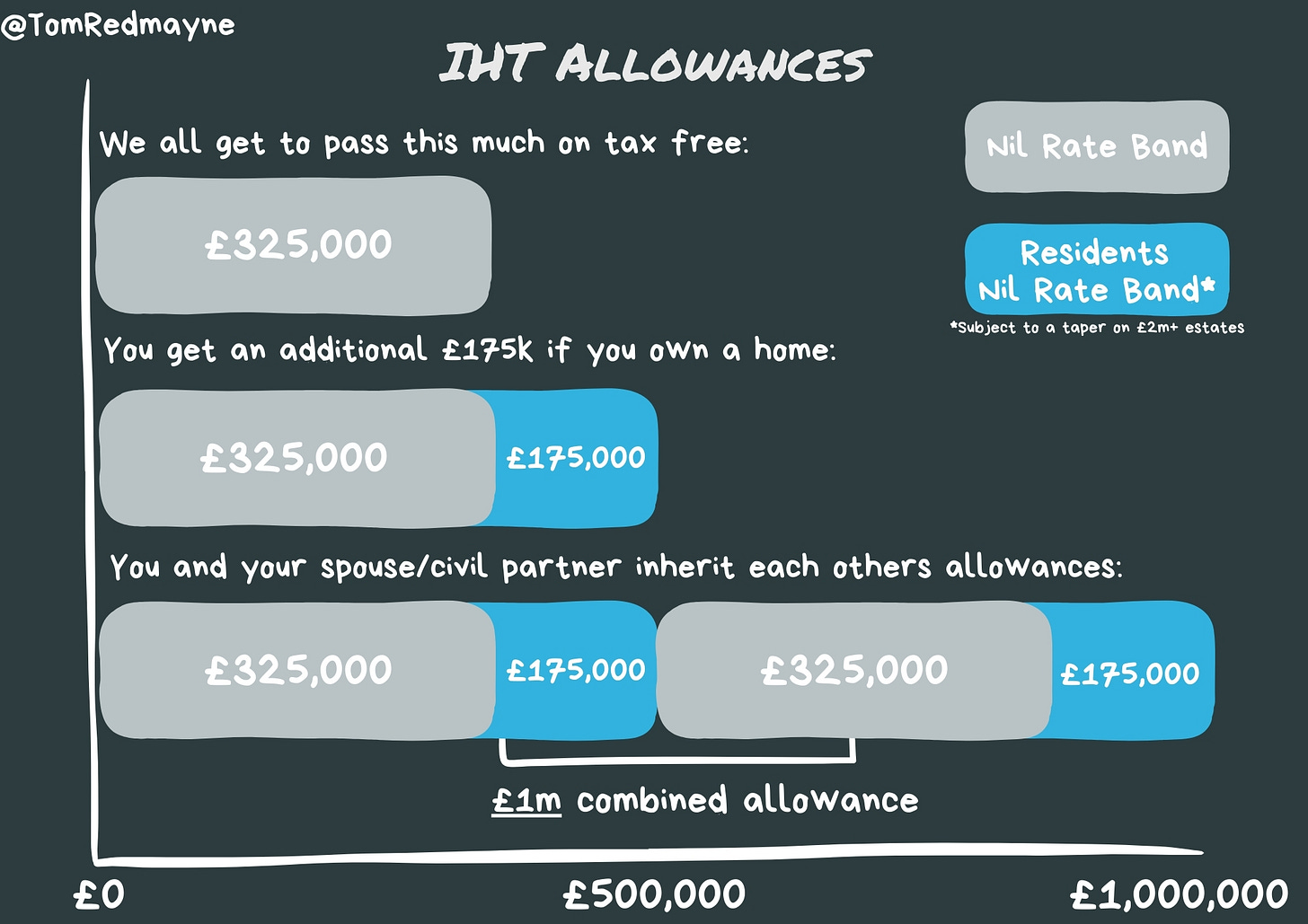

IHT is - typically - a 40% tax on the value of an estate above and beyond the tax allowances provided by the government.

For a married couple who own a home, this currently means the estate pays no IHT on the first £1,000,000 of assets - hence why IHT is not a problem for most people.

If married, we can pass on an estate worth up to £1m tax-free to our heirs2.

Here are the current tax allowances:

As it stands, pensions sit outside of our estates for IHT purposes; however, it’s Labour’s intention for them to be brought inside the reach of IHT from 2027.

Goalposts & Pensions

The reality of financial planning is that the tax and regulatory goalposts are always shifting, like a treasure map forever altering its route to the buried loot.

Pensions being brought back into estates from 2027 is a big change.

Exactly how the implementation is going to work is up in the air, with a consultation taking place until January 2025 - until the detail has been confirmed there’s not too much more to say (stay tuned).

On Making Decisions

“Some decisions are consequential and irreversible or nearly irreversible – one-way doors – and these decisions must be made methodically, carefully, slowly, with great deliberation and consultation. If you walk through and don’t like what you see on the other side, you can’t get back to where you were before.

But most decisions aren’t like that – they are changeable, reversible – they’re two-way doors… you don’t have to live with the consequences for that long. You can reopen the door and go back throughs”.

-Jeff Bezos (Mum, he’s the founder of Amazon).

(H/T to The Money Den for sharing this concept in an earlier article).

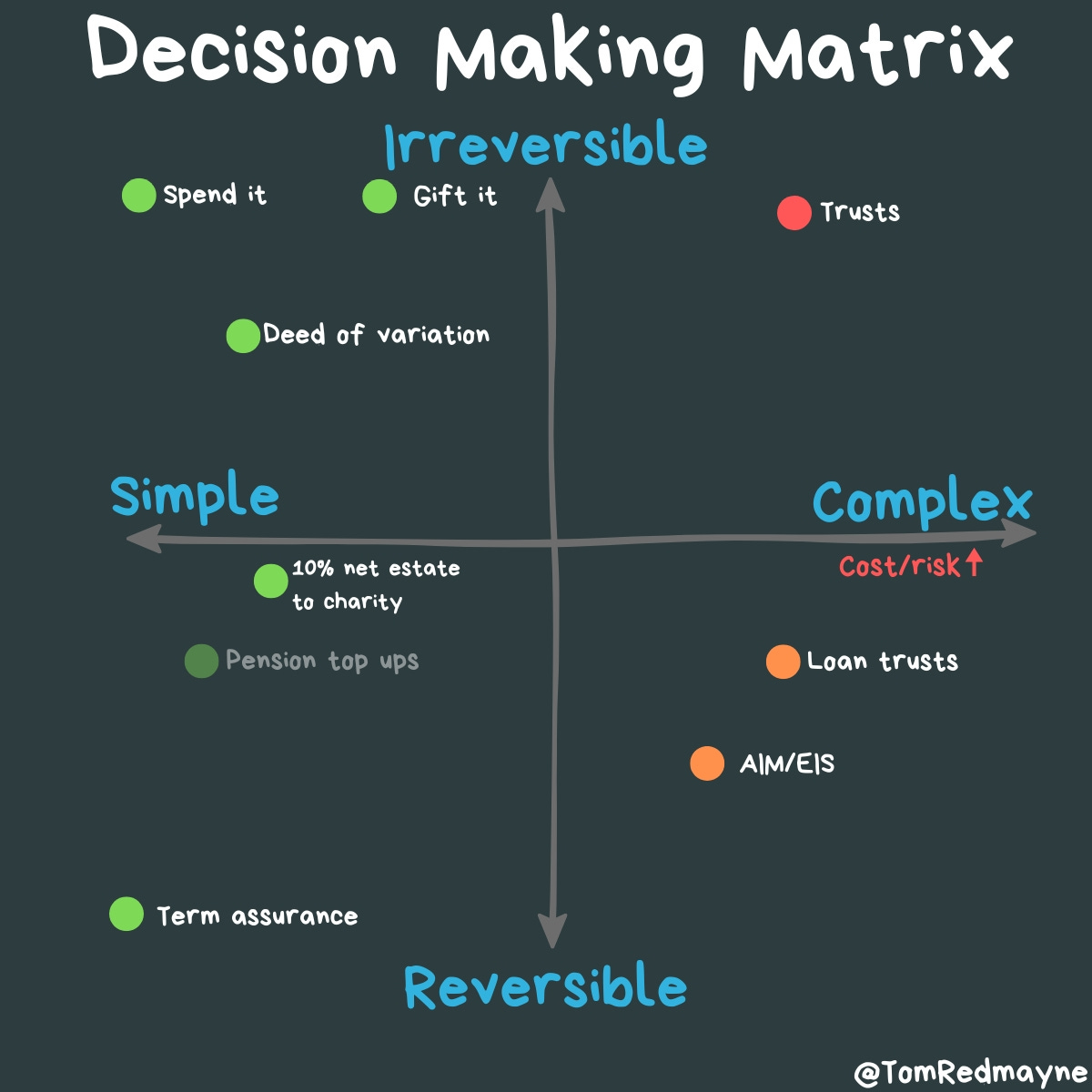

There are only two types of decisions:

Reversible (two-way doors).

Irreversible (one-way doors).

These decisions also range from the simple to the complex:

My philosophy with IHT planning - or any other decisions for that matter - is to start on the left-hand-side of the matrix and only move right when there is meaningful value in doing so - as complexity is costly and adds additional risk.

When I speak to people about IHT planning, inevitably they jump straight to trusts.

“Just put it in a trust, right?”

“Probably not”.

You’re jumping straight to one of the most irreversible, complex and costly solutions.

Trusts are (typically) one-way doors. They remove your access to the assets and bring with them ongoing admin and costs.

Yes, a trust may be suitable for your needs - but first, take a step back and look at all the other options available to you.

As Jeff says:

“These decisions must be made methodically, carefully, slowly, with great deliberation and consultation”.

Please don’t go barging through any one-way doors without a good deal of thought.

For the rest of this article I’ll run through the simpler options available to you:

Insure it.

Spend it.

Gift it.

Put a ring on it.

Insure it

Did you know you can insure your IHT liability?

Lets look at a simple example of a married couple who own their home:

You can take out life insurance to cover the liability.

Put the policy in trust.

And have it set to pay out on second death (as spousal transfers aren’t liable for IHT).

When the surviving spouse passes away, the trust will pay out the proceeds directly to the executors to pay off the IHT liability.

The benefit of this is the executors don’t have to sell any of your assets to cover the bill.

The downside is you have to pay a monthly premium, so you’ll need to ensure it is affordable. If you stop paying the premiums, the cover will stop and there’ll likely be no cash-out value (some policies do carry an investment element).

For this option to work, you have to pay the insurance premiums for the rest of your lives.

Spend it

My personal favourite.

Spend it.

Treat yourself!

You cannot take it with you. There are no pockets in shrouds.

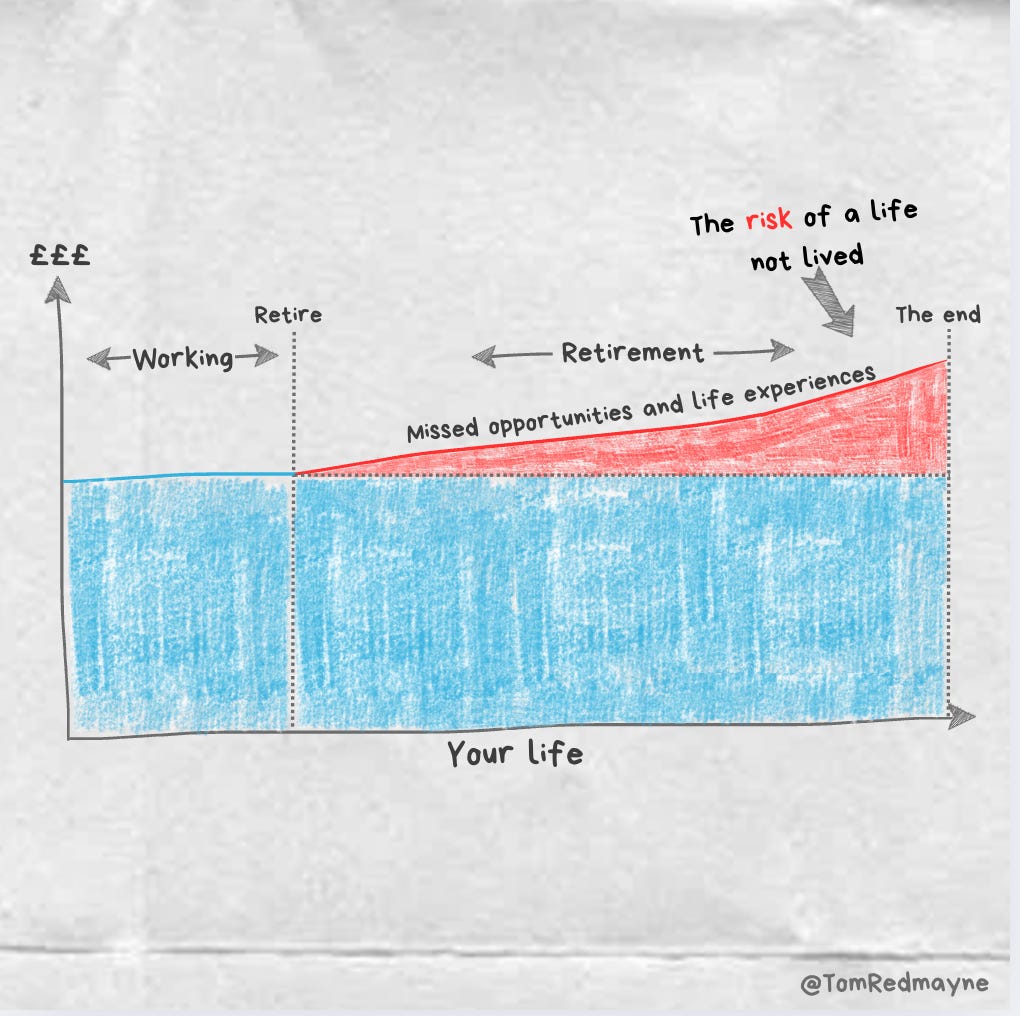

If you have an IHT liability, then you may have more than sufficient assets to cover your income needs for the rest of your life.

(If you’re unsure as to whether you have enough, or what’s a sustainable level of spending, then working with a financial planner can be invaluable - feel free to get in touch to find out more).

Spending your money whilst you’re young and healthy enough to do so is a good strategy, as tomorrow is not guaranteed.

Now, as a Financial Planner, my primary duty is to ensure my clients don’t run out of money before they run out of life:

A lesser known duty is to help people understand whether they’re able to spend more money:

And, if so, encouraging them to do so:

Intentionally spending your money on living a good life - whilst you’re fit and able to do so - has the added benefit of permanently removing said money from your estate, thereby reducing your IHT liability, ideal!

Gift it

A simple solution on paper.

Give it away.

However, families can be complex beasts and you may have some of the below worries:

A fear the money will be wasted.

A fear you’ll spoil the recipients.

A fear you’ll be looked at as a cash cow to be ‘tapped up’ moving forward.

A fear you may actually need the money in the future.

All perfectly reasonable worries and ones, I’m afraid, I largely don’t have the answers to. I can help my clients ensure the fourth point isn’t an issue; however, the first three are down to family dynamics and your own preferences.

If you’re not comfortable giving away money, you probably shouldn’t do it.

With that said, the younger the recipients, the more valuable a gift can be.

Typically, the earlier a gift is received, the more power it has to positively impact the recipient’s life. Most people receive their inheritance once they’re older and already financially secure, which dulls the impact of the money.

As always, it’s about balance.

Would the positive impact of the gift outweigh your potential fears about gifting?

Warm Hand > Cold Heart

And here we reach the core of the gifting conversation.

“It’s better to give with a warm hand, rather than a cold heart”.

Which means, make gifts whilst you are alive (‘warm hand’) to see the benefits of them, rather than waiting until you’re dead (‘cold heart’).

In an ideal world, wouldn’t it be better to see your family/friends/chosen charities enjoy the fruits of your toil whilst you still have eyes to see?

Gifting should be a positive experience for you and everyone involved; however, working out the above points first is important to ensure it doesn’t backfire.

Put a ring on it

With the impending pension changes in 2027, marriage is going to become more important for tax purposes (and who said romance is dead?!).

Pensions are set to be added to the value of an estate on first death, which means if you aren’t married then IHT may be due (as you won’t be benefiting from the spousal exemption - where no tax is paid on asset transfers between spouses).

Before you ask, ‘common-law partners’ have no bearing on proceedings. That term has no legal weight in the UK.

If you’re not married, your partner could lose a decent chunk of your pension to IHT.

So, getting married could well be the difference between your partner being financial secure after you’ve died or being left in need of money - now, that may well be romantic after all!

(PS, if you’re assuming your ‘common-law partner’ will automatically inherit your assets, you’d be mistaken. You need to ensure you have an up-to-date will in place for this).

The Best legacy

There’s no way to write this next section without being cheesy; so, please forgive me as I shed my hard, English exterior to reveal a gooey, American-like, interior.

It’s all too easy to get caught up with IHT mitigation and only worry about how much of your hard-earned cash will be gobbled up by the bloated behemoth - otherwise known as the UK state - which is vacuuming up ever greater sums of our money into a black, vacuous hole of mismanagement where it’s somehow able to find enough for wasteful endeavours but not enough to maintain our crumbling infrastructure and public services.

It’s important to put that (justified) grievance aside, because love is the best legacy.

If your heirs have an IHT bill to settle on your estate then, in all likelihood, they’ll be OK - they’ll still be receiving significant assets from you.

Aside from the cold, hard cash, what will your legacy be?

Is there a greater gift you can give to your family than the unparalleled love and support of a parent?

Knowing that when you eventually depart this mortal realm - leaving your children to fend for themselves on our dusty, little space rock - you can do so in the knowledge that they knew true love and are well equipped to continue without you.

A love they can carry in their hearts long after you’ve gone.

A love they can pass on to their own children.

The love of a parent is one thing the government can’t touch.

It’s an invaluable gift that cannot be tarnished by a bureaucratic body.

You don’t need to put it in trust.

You don’t have to rely on any tax allowances.

You don’t have to do anything clever or complex.

You just have to provide it.

We’ll all be dust one day.

So too will HMRC and all our money.

Real wealth is found in the quality of our relationships.

Tax-efficiency and mitigation is important, but it isn’t everything.

With that said, onwards to some practical planning steps!

IHT Planning Checklist

The below is a non-exhaustive, step-by-step, list to get your started on your IHT planning journey.

Step 1:

Ensure your own financial security and standard of living first:

Understand your current financial position (assets/liabilities/income/expenditure).

Decide on your future wants, needs and aspirations and how much this will cost on an annual basis? (This will give you an annual income figure to aim for).

Review your investments and sources of guaranteed income to ensure they are suitable for your needs.

Work out where your required annual income comes from. (Which assets will you draw on to meet your needs? And in which order?).

Stress-test your plan to ensure it is sustainable and not overly reliant on strong market returns.

Ensure you have sufficient cash holdings in case of unforeseen expenses or temporary market declines.

Regularly monitor your financial position to ensure everything remains fit for purpose and stay abreast of all tax and regulatory changes as they pertain to your personal circumstances.

Once you’ve built your financial plan and are confident you have sufficient assets and income to sustainably fund your desired standard of living, then you can begin to focus on how best to mitigate your IHT liability.

Step 2:

Work out if you have an IHT problem:

If so, what’s the liability?

Is it large enough to warrant the effort of mitigating against it?

Step 3:

If you have a liability you consider worthy of mitigating:

Start with my decision-making matrix and run through all the options from the simplest to the most complex and decide which ones are correct for your personal circumstances (please don’t barge through any one-way doors before carefully considering the alternatives).

Implement the chosen strategies based on your circumstances, whilst keeping an eye on the costs involved (more on that below).

Ensure your wills are up-to-date to reflect your wishes on death and consider putting Powers of Attorney (PoAs) in place to reflect your wishes if you don’t die.

Again, regularly monitor your financial position to ensure everything remains fit for purpose and stay abreast of all tax and regulatory changes as they pertain to your personal circumstances.

Alternatively, seek help from a regulated and qualified financial planning professional of your own choosing.

Chartered Financial Planners are a great place to start, if I may say so myself!

(if you go to a solicitor - odds on - they’ll go straight to discussing trusts).

This is not personal advice based on your circumstances. All views are my own. Not advice.

The cost of inaction

If you don’t do anything, what will the eventual cost be?

It might not be much, in which case, getting on with your life might be the preferable solution.

On the other hand, it could be high:

a large IHT bill for your estate to pay (if you care about such things).

regret later in life that you didn’t take action sooner (the closer you are to the end of your life, the harder it is to mitigate IHT).

the niggling stress of the ‘get-round-to-it’ hanging over you.

Added emotional stress on your executors having to administer a complex estate.

Typically, the earlier you take action, the larger the benefits.

Cost ≠ Value

Cost is what you pay, value is what you get.

Higher value estates typically bring more complexity and risk, which results in a higher cost base for any solution.

If you are going to pay any professional or product provider to implement a solution, there will be costs involved and it is up to you to determine the value of said costs against the cost of doing nothing or something else.

Paying X% on your assets to achieve a desirable outcome should lead to beneficial outcomes for you and your family - not to mention all the intangibles, such as the peace of mind derived from financial clarity and security.

If comparing between different solutions/providers/professionals, it’s imperative to have a firm grasp of each solution, proposed benefits (both tangible and intangible) and charging structures to ensure you are comparing apples with apples.

Yes, one solution may seem cheaper on the face of it, but when you look under the bonnet the ongoing costs (or opportunity costs) could soon eclipse the alternatives or it may not have as many proposed long-term benefits.

Only you can decide whether the juice is worth the squeeze.

Ready to secure your financial future?

Clicking the button will generate a contact form.

We'll then have an initial conversation to better understand your needs/wants/aspirations and to see whether my services would be a good fit.

Thanks for reading,

Tom Redmayne

Chartered Financial Planner

Supporting my work

If you enjoy my content, here’re some simple ways to lend support:

Giving the article a like (if you liked it) - this helps the Substack algorithm find me and recommend me to new readers.

Subscribing (if you haven’t already).

Sharing also really helps my work find a wider audience:

Thank you!

This is not personal advice based on your circumstances.

All views are my own.

https://www.gov.uk/government/statistics/inheritance-tax-liabilities-statistics/inheritance-tax-liabilities-statistics-commentary#:~:text=in%20the%20tax%20year%202021,since%20statistics%20were%20first%20produced.

The residence nil-rate band (RNRB) tapers when the net value of an estate exceeds the £2 million taper threshold:

For every £2 the estate is worth more than the taper threshold, the RNRB is reduced by £1.

This means that estates worth more than £2.35 million may not benefit from the RNRB.

Love the decision making matrix Tom. That is brilliant.

Nice one Tom. It’s hard to distill the nuance around IHT planning and you did it! 👏. Agree with David on the matrix. A schematic or drawing always wins the day for me.