Risk ≠ Volatility

The price of admission

Welcome & Thank you

Welcome to all my subscribers, new and old - it’s good to have you here!

Following my previous article going ‘low-key viral’, my subscriber count increased by 32%.

Thank you to everyone who shared, and more importantly, enjoyed Bricks & Slaughter.

Onwards!

In the world of investing volatility is used as the primary measure of risk.

However, once you understand volatility, you'll realise the real risk is not investing:

Yes, volatility makes for an excellent headline, but it is not a real risk over the long term - in fact, it can even be your friend.

What is Volatility?

Put simply, it’s the short-term price fluctuation of assets driven by whether investors are hopeful or fearful (AKA ‘market sentiment’).

Therefore, you could think of volatility as a measurement of fear or greed.

Here’s how it looks over time in relation to investment returns:

You'll note from the above graph that investment returns (the green line) are correlated with volatility (the red line) in the short term - as a spike in fear typically leads to a temporary dip in the markets.

However, as seen above, following a spike in fear the investment markets have a habit of rising - which isn’t a particularly risky outcome.

So, why then, is volatility used as the primary proxy for risk?

Because it is easy to measure and visualise.

I agree with Howard Marks who said:

"Academics settled on volatility as the proxy for risk as a matter of convenience".

What then is risk?

What is Risk?

Risk is the possibility of something bad happening; such as loss, injury or heartbreak.

Therefore, in investment terms, risk is:

Permanent loss of your capital (if you lose your money it’s ‘game over’).

The purchasing power of your cash being eroded away by inflation.

Not being able to maintain your desired standard of living in the future.

Concentration of your capital (e.g. only being invested in one company, which leaves your money exposed to permanent loss).

Risk is not short term price fluctuations.

Zoom In

Cast your mind back to 2020.

We experienced peak fear when Covid swept the world, sending stock markets tumbling by over 30%:

During this period of volatility billions were pulled out of the stock market (people selling into a falling market).

For more information on why that was a terrible idea, check out my article, Buyer Beware: Active Investing.

However, as we can see, cash and bonds remained - broadly - steady.

Global bonds did take a hit to begin with, which is not meant to happen (they are meant to act as a counterweight to equities) - further fanning the flames of fear!

Everything. Went. Down.

So, how long did this fear grip the world and keep the stock markets in perpetual darkness?

A year?

2 years?!

About 5 minutes:

By early November, the global stock markets had recovered from the Covid hysteria and overtaken bonds, and finished 2020 strongly to make it a positive year (who’d have guessed that back in March?!).

A year on from the start of the temporary decline, equities were up 14.86% and bonds were up 1.96%1, with cash remaining steady at 0.65% - a timely lesson in not trying to speculate on future returns.

Zoom Out

As we’ve just seen, global stock markets are volatile in the short-term; however, if you zoom out they tend to only go one way... up.

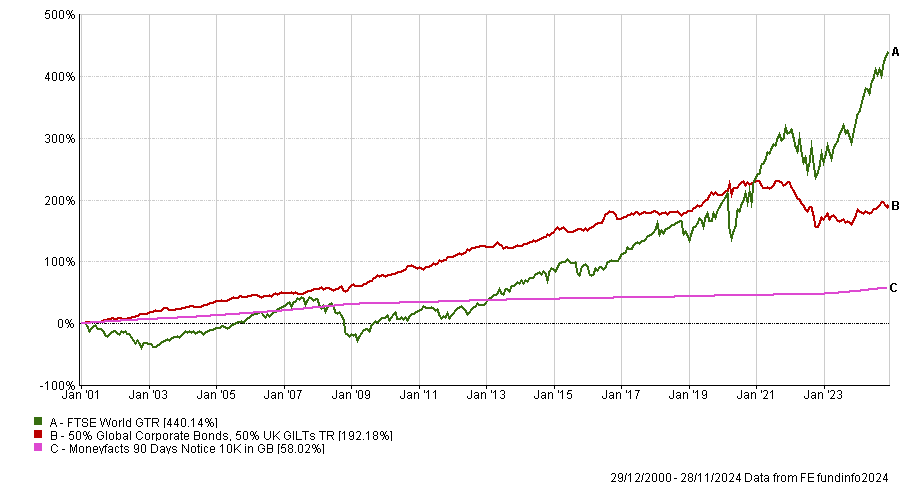

Lets zoom out further and look at the different asset returns since 2001 (a period which has included several ‘once-in-a-century’ moments):

Well. Well. Well.

The most volatile asset doesn’t look particularly risky from this vantage point.

“Volatility is the price of admission”

-Morgan Housel

Real returns - which are all that matter - are found on the other side of volatility.

Zoom out even further and over any 20 year rolling period since 1926 stock markets have never lost money (they've always provided real returns over inflation).

As volatility is baked into the investing experience, lets move on to what we can do about it.

For more information on the importance of real returns, check out my article, Don’t Be Careful, Be Competent.

(This is one of my personal favourites).

The Price of Admission

Volatility is the price of admission to the long term gains available through equity investing.

Temporary market declines are a feature, not a bug.

It will happen - likely multiple times during your investment journey.

So, what can you do about it?

Welcome volatility and remember, “this too shall pass” when your portfolio temporarily declines (possibly for a sustained period).

Load up your portfolio with a certain percentage of bonds to smooth out the ride - acknowledging that the long-term returns will be lower but it will allow you to stay invested during periods of turmoil (it’s better to be invested sub-optimally, than not at all).

Hold a sufficient amount of cash so that you are not reliant on your investments during temporary market declines (how much cash? It Depends).

A mix of all three.

Daniel Crosby spells it out brilliantly in his book, The Laws of Wealth:

"The sooner you can accept there will be 10 to 15 bear markets [temporary market declines] in your lifetime, the sooner you will be able to invest in a way that manages the thing you ought to fear most - the possibility that you will have insufficient funds to live the life of your dreams".

As Daniel highlights, this is the real risk you ‘ought to fear most’ - running out of money before you run out of life:

As a Chartered Financial Planner, my primary duty is to mitigate this risk. Which will, typically, involve a portfolio primarily invested in global equities2.

Want to discuss your financial future?

Equity Investing

The key thing to understand with equity investing (if sensibly diversified) is that you only experience a real, permanent loss when you sell. If you don't sell, or regularly check your investments, then you will be unaffected by short term price volatility.

For example, many people think house prices only go up, making them a safe investment; however, that’s simply a perception as we don’t get our houses valued every 5 minutes - if you wait long enough, most things rise in value.

The below graph shows that the good times (bull markets) significantly outweigh the bad times (bear markets):

To build real wealth (outpacing inflation) you need to invest in productive assets, such as global equities.

As we’ve seen, not putting your money to work is likely the real risk.

Bonds and cash provide a respite from the scary fluctuations of the global stock markets, however that comes at the cost of lower expected returns.

A price many cannot afford to pay.

Pound Cost Averaging

Finally, volatility can be your friend - especially if you are regularly investing into funds over the long term (most of us are doing this through our workplace pensions).

Pound cost averaging, which is drip feeding your money into the markets over time, means you buy at the highs and the lows:

When prices are high, you buy fewer units.

When prices are low, you buy more units.

Buying at the lows is like a sale, where you can get more units and buying when the markets are high means you purchase less of the expensive units.

For some reason, everybody loves a sale until the stock market’s on sale…

Here’s pound cost averaging in action within my workplace pension:

If you are a long-term investor paying in regular contributions then you should be more than happy when the market temporarily drops, as you get more for your money!

In Summary

A portfolio primarily invested in global equities is likely required to help ensure you don’t run out of money before you run out of life.

You can mitigate volatility by not regularly checking your investments.

Attempting to time when to buy and to sell is a futile endeavour.

Real returns are found on the other side of volatility.

Ready to secure your financial future?

Clicking the button will generate a contact form.

We'll then have an initial conversation to better understand your needs/wants/aspirations and to see whether my services would be a good fit.

Thanks for reading,

Tom Redmayne

Chartered Financial Planner

Supporting my work

If you enjoy my content, here’re some simple ways to lend support:

Giving the article a like (if you liked it) - this helps the Substack algorithm find me and recommend me to new readers.

Subscribing (if you haven’t already).

Sharing also really helps my work find a wider audience:

Thank you!

This is not personal advice based on your circumstances.

All views are my own.

It’s difficult to find a long-term aggregate index of corporate and government bonds, so I made my own. I kept it simple with 50% global bonds and 50% UK GILTS. It performs in a similar manner to Timeline Tracker 0, which is good enough for me (happy to hear about alternatives).

👌🫡