To support the publication and receive new articles directly to your inbox, please subscribe:

Tax efficiency = structuring your finances to reduce the amount of tax you pay while remaining safely within HMRC’s rules (no dodgy business here!).

Being tax efficient involves effectively utilising a mixture of the tax allowances, reliefs and financial products available to you - think of them as the different ‘financial levers’ you can pull:

The goal = keep more of your money, so you can spend it on what’s important to you.

“The UK tax system is archaic; filled with nuances, hidden ‘marginal rate’ traps and seemingly nonsensical rules”.

Whilst paying tax is a necessary part of living in a sometimes functioning society - and, in general, we shouldn’t have a problem doing so - there’s no point paying more than you have to. There are no gold stars awarded for needlessly high tax bills.

Professionally, a key part of my role - which I enjoy - is to ensure the financial advice I provide is delivered in a tax-efficient way (where possible/sensible).

What we’ll cover

It’s impossible to provide a definitive guide on tax-efficiency, as there are so many variables which are dependent on your circumstances - your employment status, income level, income sources etc.

So, here’s what we’ll go through:

First, we’ll cover off some broad areas which are widely applicable to professionals, business owners and retirees.

Secondly, we’ll look into some specific ideas for business owners, as they typically have more financial levers available to them (if you’re not a business owner, feel free to skip ahead to the final section).

Finally, we’ll discuss the ‘Tax Efficiency Trap’ which anyone can fall in to.

For the sake of brevity, I’m taking it as read that you have a good understanding of how UK income is/isn’t taxed. If you need to polish up, I have a comprehensive article here:

Widely Available Financial Levers

Lets begin by looking at the different levers available to most:

Tax allowances and reliefs.

Tax wrappers.

Pensions (don’t miss this section if you want a ‘free lunch’!).

Income.

Tax Allowances & Reliefs

There’s a large number of allowances and reliefs which UK taxpayers can benefit from, dependent upon their circumstances.

Here’s a non-exhaustive list, which is subject to change:

Understanding the allowances and reliefs available to you is the first step in becoming more tax efficient - working with a financial planner and/or an accountant can help with this.

Tax Wrappers

A ‘tax wrapper’ is a type of investment account which has beneficial tax treatment.

Once your money goes in, the investments are then protected and able to grow free from certain taxes (the benefits vary depending on the account).

The main ones are Individual Savings Accounts (ISA) and pensions, along with a non-wrapped account, the General Investment Account (GIA):

Many individuals never have need for a GIA and build their wealth exclusively within Stocks & Share ISAs and pensions.

Pensions

Pensions are so important they get their own section!

Unfortunately, they’re chronically misunderstood.

I’ve attended many networking events where any utterance of the word ‘pension’ sends a shiver down my victim’s fellow attendee’s spine, before they go on to tell me why they “don’t do pensions” - which is usually due to some abstract notion that they’ll either die before they can access it - unlikely - or that property is the way to go (it probably isn’t).

More fool them, I say.

Pensions are wealth creation machines.

In the UK, they’re one of the best vehicles for building wealth.

Like ISAs, your investments grow free from income tax and capital gains tax.

However, unlike ISAs, your pension contributions also receive tax relief and, if you’re employed, your employer will also contribute to your workplace pension (which is close to being a free lunch).

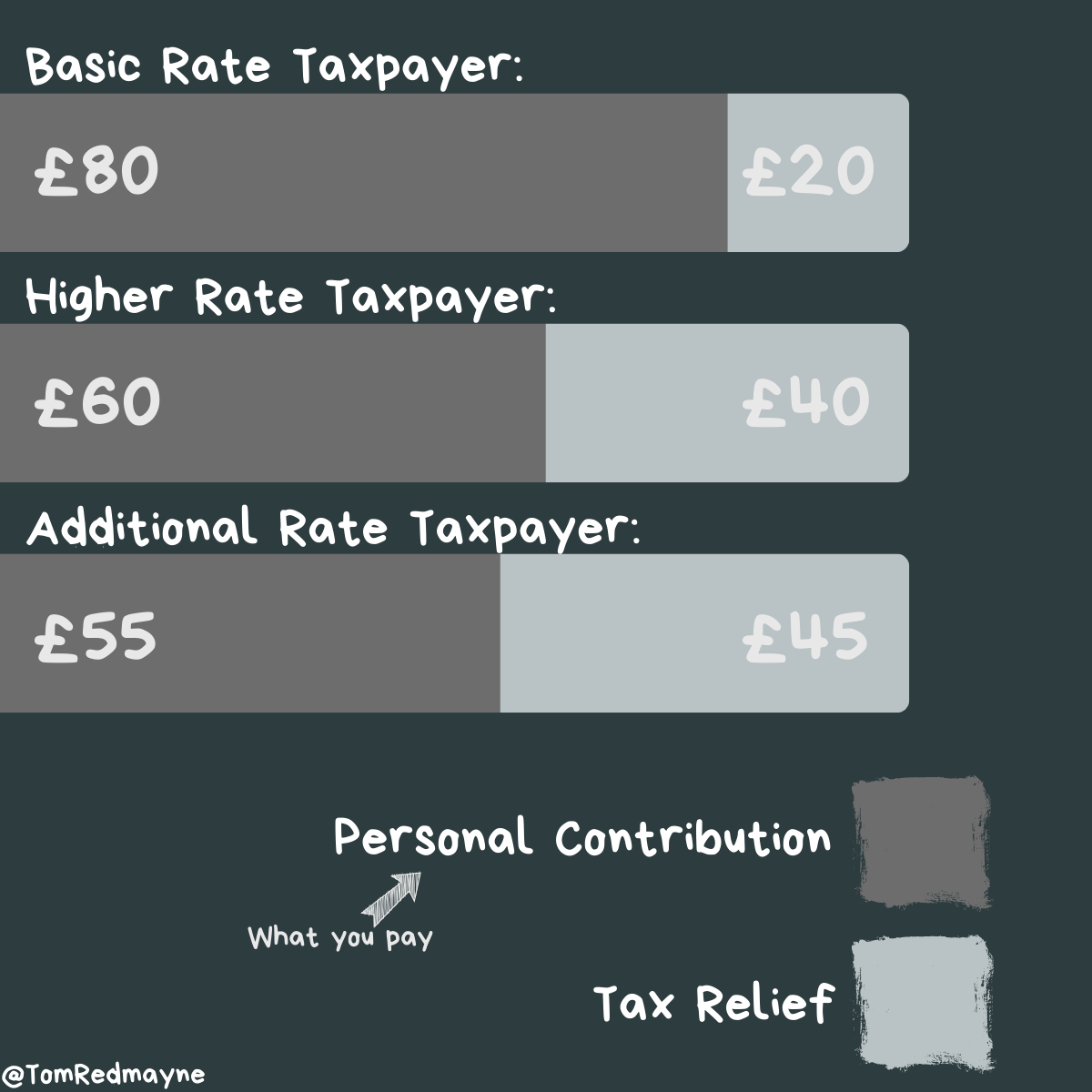

Tax Relief

Lets look at what it costs for you to put £100 into a pension:

Yes, the more you earn, the higher your tax relief - don’t shoot the messenger.

OK, how about when we throw employer contributions into the mix?

Employer Contributions

Lets look at a £2,000 per month salary, using basic salary as pensionable earnings, it may look like this:

125% uplift? Decent.

You’ve more than doubled your money and you haven’t even invested it yet!

Bonus round

As if the above benefits aren’t enough, here’s two more:

Pension contributions reduce your taxable income, meaning they can be used to avoid the 62% tax trap - read about it in detail here.

The same method also works for keeping your income down to avoid the High Income Child Benefit Charge.

Withdrawals

You can’t withdraw from them until your mid-to-late 50’s.

25% of the pot is tax free.

The remaining 75% is treated as taxable income.

We’ll be touching on pensions again shortly, as they have an added tax efficiency benefit for business owners.

Want to discuss pension planning?

Income structure

The UK tax system effectively has four different tiers for income tax, which allows some people to be more tax efficient with their income than others:

PAYE income: 28% / 42% / 47%*.

Self-employed income: 26% / 42% / 47%.

Most other income (pensions, rental income etc.): 20% /40% / 45%.

Dividend income: 8.75% / 33.75% / 39.35%.

*Scotland - for some reason - is an outlier and has 7 income tax brackets…

No one is restrained to one tier, in reality many of us will have income that falls into two or three of them.

For more information on this check out my income tax article.

OK, lets move on to business owner specific levers.

Business Owners’ Financial Levers

Dear employee/retiree, please feel free to skip to the next section and grand finale, ‘The Tax Efficiency Trap’.

Welcome, business owners.

Whilst successive government budgets have squeezed your allowances, reliefs and increased your cost base, there are some perks remaining!

A benefit of owning a business - amongst all the added risks and responsibilities that come with shouldering the majority of the UK workforce - is that you have more flexibility and financial levers you can pull for tax efficiency.

In this section, we’ll cover off the following:

Protection premiums

Income & dividends

Pension contributions

Protection

Hopefully, you already have sufficient insurance policies in place for you, your family and your business - if not you/your business might be exposed to a Single Point of Failure (SPOF).

As a business owner, it’s possible to move the liability of paying for some of your insurance premiums onto the business (as an allowable business expense):

If you’re a business owner with a personal income protection policy or life insurance policy, ask yourself why (there may be a good reason), as you’re paying for it out of your post-tax income.

You could instead set up a policy through your business, with the premiums likely being deducted from your gross profits as an allowable business expense.

(Please check with your accountant - this isn’t tax advice).

Income & Dividends

As I’m sure you know, business owners routinely draw a lower salary and then top up their income via dividends, as it's more tax efficient (even with the lowered dividend allowance).

Lets look at a simplified example of an employee on £60,000 vs a business owner drawing £60,000…

Employee:

Business owner:

£8,104 is quite the saving in comparison to the employee!

Dear employee, if you’r reading this, please remember:

The business owner has likely taken on significant levels of risk.

They probably employ people; therefore, their business will also pay ‘employer NI’.

They have to shoulder the administrative burden of employment.

The company’s profit is subject to corporation tax (at either 19% or 25%).

Employees benefit from a level of comfort and protection that business owners do not regularly enjoy.

If nobody started a business, then there’d be no employment for private sector workers - there have to be some incentives for the risks and stress involved!

Pension Contributions

Déjà vu?

Pensions are the gift that keep on giving!

Do you wish there was a way to tax efficiently draw profits out of your business for your own personal benefit?

Then look no further…

Pension contributions are - typically - an allowable business expense, meaning the contribution amount is deducted from your gross profit.

You can put up to £60,000 per tax year into your pension - avoiding income tax and NI.

The money can then be invested to grow whilst you keep on working, hopefully leaving you with a healthy pension pot to draw income from in the future1.

For most business owners, it’s a no-brainer to make the most of this strategy.

Please speak with your advisers and accountants before making any decisions based on the above, pensions are complex - this is not personal tax advice based on your circumstance. Please be aware of the wholly and exclusively test. All views my own. Not advice.

Want to discuss this topic in relation to you and your business?

The Tax Efficiency Trap

I often come across people who are ploughing headstrong into the ‘tax efficiency trap’.

Unlike it’s cousin - the 62% trap - this particular tax trap isn’t monetary, it’s Psychological.

The tax efficiency trap is when you become overly focussed on saving tax, however small the saving and whatever the opportunity cost.

Whilst it’s good to reduce your tax bill, you shouldn’t let it rule your life and decisions.

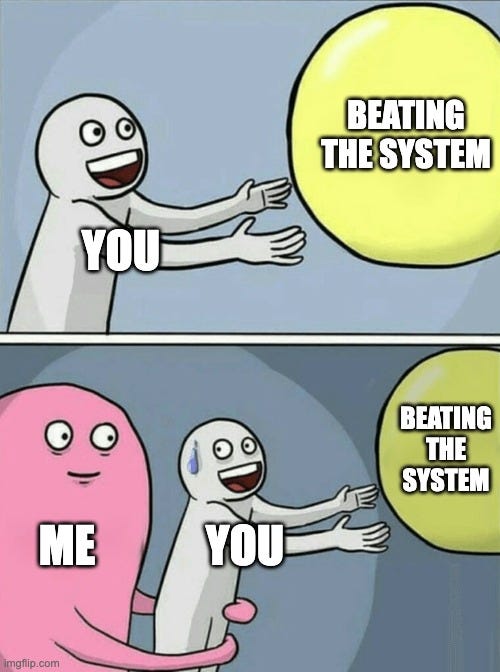

The ‘Beating The System’ Paradox

If you always play to ‘beat the system’ then you may end up missing out on life experiences and when you die, you could end up leaving a large proportion of your wealth to the taxman (‘the system’ gets you in the end!).

Attempting to beat the system may also lead to you exploiting grey areas (which can come back to bite you), or sliding into literal tax fraud (see R&D Tax Relief fraud).

I’m all for avoiding unnecessary tax payments; however, that shouldn’t be the main objective.

Instead, you should decide what you want to do with your life, work out how much money you’ll need to service said objective(s), then - and only then - look how to extract that income tax efficiently.

If you can afford to, why not take the tax hit and enjoy your money?

Treat yourself. Treat your family. Enjoy life.

Trade in some of your fun tokens for lasting memories. Life can be short and obsessing over tax savings isn’t an inspiring existence.

We’ll never be as young as we are now and we never know what’s round the corner.

Do you really think you’ll be on your deathbed reminiscing about how tax efficient you were? Do you really want the only stories you have to tell your grandchildren about is how you managed to reduce your payments to HMRC?

If you’re reading this, the odds are you’re a smart and capable individual. You can always make more money.

Yes, be sensible and avoid paying stupid amounts of tax; however, sometimes its better to just pay the tax.

Do it.

Let go of the need to ‘beat the system’.

See how it feels.

Treat yourself.

Saving tax shouldn’t come at the cost of a life not lived.

Ready to secure your financial future?

Clicking the button will generate a contact form.

We'll then have an initial conversation to better understand your needs/wants/aspirations and to see whether my services would be a good fit.

Thanks for reading,

Tom Redmayne

Chartered Financial Planner

Supporting my work

If you enjoy my content, here’re some simple ways to lend support:

Giving the article a like (if you liked it) - this helps the Substack algorithm find me and recommend me to new readers.

Subscribing (if you haven’t already).

Sharing also really helps my work find a wider audience:

Thank you!

This is not personal advice based on your circumstances.

All views are my own.

You’re deferring the tax until a later stage, as 25% of a pension is tax-free and 75% is taxable (subject to allowances etc.). In the meantime, your money is growing in a tax-sheltered environment and you may be able to manage your pension withdrawals tax efficiently in the future.